In real estate, the term “buyer’s market” gets thrown around a lot, but what does it actually mean for you? Simply put, it’s a power shift where the supply of homes for sale outweighs the demand from buyers. This gives you, the purchaser, a whole lot more leverage at the negotiating table.

Think of it as having more homes for sale across Dallas than there are people actively looking to buy them.

What Exactly Is a Buyer’s Market in Dallas?

Picture this: it’s a Saturday night in the popular Bishop Arts District, but a normally packed restaurant has more empty tables than people waiting for a seat. To fill those tables, the manager might offer a happy hour special or a free appetizer. This is precisely what happens in a Dallas buyer’s market, just with houses instead of dinner tables.

When the number of homes listed for sale climbs higher than the number of active buyers, the entire dynamic of the market tilts in your favor.

This imbalance means you’re in a much stronger position. You’ll face less competition, have more breathing room to weigh your options, and gain significant negotiating power. It’s the complete opposite of the frantic bidding wars that break out when inventory is scarce. A buyer’s market is officially marked by a surplus of homes, which typically leads to lower prices or much slower price growth. You can explore more data on this pricing impact over at Redfin.

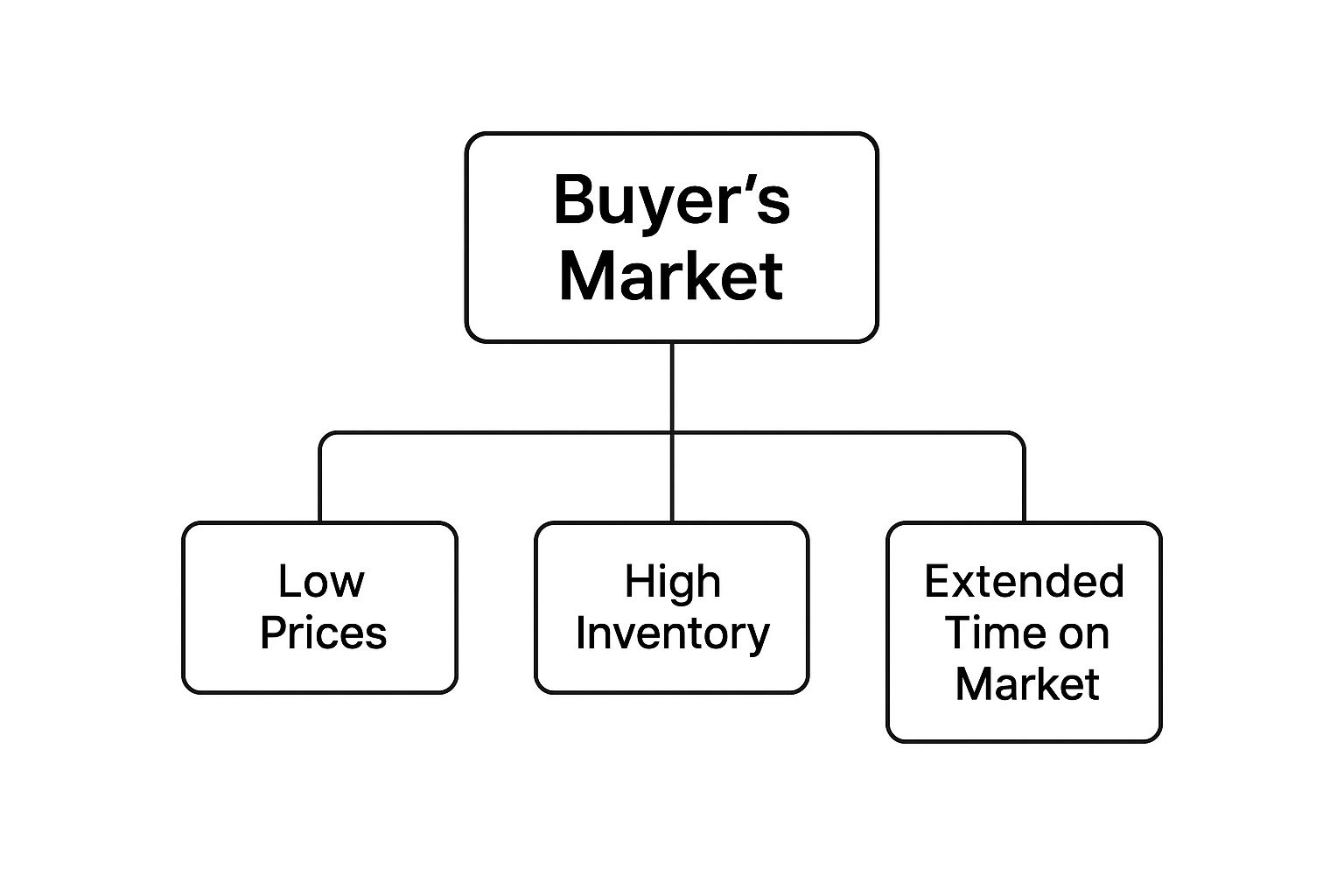

This image really breaks down the core pieces of a buyer’s market, showing how high inventory and more days on the market ultimately lead to better prices for buyers.

As you can see, the main takeaway is that an oversupply of properties has a direct effect on pricing and how fast homes sell, creating a fantastic opportunity for anyone looking to buy.

The Key Characteristics of a Dallas Buyer’s Market

Several tell-tale signs define this type of market. Instead of feeling like a chaotic rush, the home-buying process becomes more deliberate and strategic, putting you in the driver’s seat.

Here’s what you can expect to see:

- A surplus of available homes: You’ll start noticing more “For Sale” signs than usual in neighborhoods from Plano to Oak Cliff. This increased inventory gives you a much wider selection to choose from.

- Longer time on the market: Homes don’t get snapped up in a single weekend. Properties might sit for several weeks or even months, giving you plenty of time to make a thoughtful decision without feeling pressured.

- More price reductions: Sellers become more willing to lower their asking price to catch the eye of a buyer. This is a clear signal that they need to compete for a smaller pool of house hunters.

- Willingness to negotiate: Sellers are often much more open to seller concessions. This could mean they agree to help pay for your closing costs, offer credits for repairs, or accept an offer that includes contingencies (like the sale of your current home).

To make it even clearer, let’s look at how a buyer’s market stacks up against its counterpart, a seller’s market.

Buyer’s Market vs Seller’s Market at a Glance

This table provides a quick comparison of the key characteristics of a buyer’s market versus a seller’s market, helping you quickly grasp the fundamental differences.

| Characteristic | Buyer’s Market | Seller’s Market |

|---|---|---|

| Inventory | High | Low |

| Competition | Low | High (Bidding Wars) |

| Prices | Stagnant or Falling | Rising Quickly |

| Days on Market | Long | Short |

| Negotiating Power | Buyer has the advantage | Seller has the advantage |

| Concessions | Common | Rare |

Understanding these differences is crucial. In a buyer’s market, you have the time and leverage to find the right home at the right price, which is a game-changer for your real estate journey.

Key Signs a Buyer’s Market Is Emerging in Dallas

Catching a buyer’s market before it fully arrives gives you a serious leg up. Instead of just reacting to the news, you can get ahead of the curve and adjust your home-buying strategy. In the Dallas-Fort Worth area, a few key metrics act like early warning flares, signaling that the market tide is turning.

One of the most telling indicators we watch is the Months of Supply of Inventory (MSI). Think of it this way: it’s the number of months it would take to sell every single home currently for sale in Dallas if no new listings hit the market.

As a general rule, an MSI of over six months is a strong signal that we’re entering a buyer’s market in Dallas. When you see that number climbing, it’s a clear sign supply is outstripping demand, which puts you, the buyer, in a much stronger negotiating position.

Another critical sign is the average Days on Market (DOM). When you start noticing that homes in popular neighborhoods like Lakewood or Southlake are sitting on the market longer, it’s a clear sign that the buyer frenzy has died down. A rising DOM means less competition and, more importantly, more time for you to make a smart, unhurried decision.

Watching for Price Adjustments

Beyond the hard data, what’s happening on the ground in Dallas provides undeniable proof of a market shift. A jump in price reductions is a dead giveaway that sellers are finally having to adjust their expectations to meet a smaller, less frantic pool of buyers.

Keep an eye out for these trends as you browse:

- More “Price Reduced” Tags: When you’re scrolling through Zillow or Redfin for homes in hot spots like Frisco or Plano, you’ll start seeing a lot more listings with price cuts. This isn’t random; it’s a direct response to a lack of buyer excitement at the original price.

- Sellers Offering Incentives: In a Dallas buyer’s market, sellers have to get creative to stand out. You’ll see more listings advertising that the seller is willing to cover closing costs or offer credits for repairs you find during the inspection.

These signals—a higher MSI, longer DOM, and frequent price drops—are your cues. They tell you the market is leaving the seller-driven frenzy behind and moving into a phase where a patient, strategic buyer can find a fantastic deal.

Why Buyer’s Markets Happen in Real Estate Cycles

A buyer’s market doesn’t just materialize out of thin air. It’s a natural, predictable phase of the real estate cycle, driven by much larger economic forces that ebb and flow over time. When you understand these patterns, you can see an emerging Dallas buyer’s market not as a fluke, but as a recurring opportunity.

Often, major economic shifts are the main catalyst. Think about what happens when national interest rates change—it can cool off buyer demand in Dallas almost overnight. As borrowing money gets more expensive, fewer people can afford to jump into the market, which can quickly lead to an oversupply of homes for sale.

It’s a similar story with employment trends, especially in a city like Dallas with its huge corporate presence. If major companies slow down hiring or, worse, start laying people off, buyer confidence takes a nosedive. That drop in demand, combined with a steady stream of new listings, is the classic recipe for creating market conditions that heavily favor buyers in our area.

The Role of Economic Events

Looking back at historical events gives us the clearest picture of how these cycles really work. They show that while every market phase feels unique in the moment, the root causes are usually pretty similar.

The most dramatic recent example of a buyer’s market was during the Great Recession, which impacted Dallas after the 2007–2008 financial crisis. During that time, the NAHB/Wells Fargo Housing Market Index fell to its all-time low of 8 in January 2009. At the same time, new home construction completely collapsed to its lowest point since World War II.

This was the perfect storm of economic chaos and a massive oversupply of homes. It gave buyers unprecedented control. With so many properties flooding the market and so few competitors, anyone who could get a loan had their absolute pick of homes at rock-bottom prices, giving them incredible leverage.

By recognizing these large-scale economic trends, you can get much better at anticipating when the Dallas market might be shifting. For example, you can take a closer look at how specific neighborhoods react to these changes by decoding the real estate trends in the 75230 zip code. Knowing these historical patterns helps you prepare your strategy with confidence, so you’re ready to act the moment the cycle turns in your favor.

How Dallas Homebuyers Gain the Upper Hand

When the real estate market tilts, it shifts all the power from one side of the negotiating table to the other. In a Dallas buyer’s market, that power lands squarely in your lap. This isn’t just theory—it translates into real, tangible benefits that can save you a ton of money and stress.

The most obvious perk? You have way more options. A higher inventory across popular Dallas suburbs like Allen and McKinney means you can afford to be choosy. Instead of frantically racing to see a new listing the moment it pops up, you get the breathing room to visit multiple homes and really compare them, all without the constant threat of a bidding war.

Maximizing Your Negotiating Power

This is where the true value of a buyer’s market really shines through. With sellers suddenly competing for a smaller group of qualified buyers, you’re in the perfect spot to negotiate terms that heavily favor you and your wallet. Your offer becomes more than just a price; it’s a strategic move.

For example, you can confidently ask for seller concessions. Think of these as credits from the seller used to pay for a big chunk of your closing costs—which typically run between 2-5% of the home’s final price in Texas. That single negotiating point can keep thousands of dollars right where they belong: in your bank account.

A buyer’s market turns the home inspection from a simple check-up into a powerful negotiating tool. Instead of having to accept a property “as-is,” you can hand the seller a list of necessary repairs and reasonably expect them to either fix the issues before closing or give you a credit to hire your own contractors.

Building a Financial Safety Net

On top of that, you can build crucial protections, known as contingencies, into your offer without worrying that they’ll make your bid less attractive. These clauses act as an essential safety net.

A couple of key contingencies you’ll want to include are:

- Financing Contingency: This lets you walk away from the deal with your earnest money intact if, for some reason, your mortgage approval doesn’t come through.

- Appraisal Contingency: This protects you from overpaying. If the home appraises for less than your offer price, you have an out.

These advantages completely change the game for Dallas homebuyers. To see how you can apply these strategies in specific areas, our North Dallas home guide with buyer insights is a great place to start digging into local opportunities.

Your Playbook for Navigating a Dallas Buyer’s Market

Knowing what is a buyer’s market is one thing, but the real power comes from having a solid game plan to capitalize on it. When the market shifts in your favor here in Dallas, you need a clear playbook to make a truly smart purchase. It all starts with your offer.

The whole point is to come in with an opening offer that’s both strong and strategic. It needs to reflect the new market reality, not just the seller’s wishful thinking. With less competition breathing down your neck, you finally have the space to be methodical.

Craft a Strategic Offer

Your first move should always be based on hard data—specifically, recent, comparable sales in your target Dallas neighborhood. Forget the list price for a moment. A well-researched offer immediately signals that you’re a serious buyer who has done their homework.

Patience is your best friend in this environment. Use the market’s slower tempo to find the perfect property instead of feeling pressured into a decision you might regret later.

A critical piece of your playbook is getting a rock-solid mortgage pre-approval before you even start looking at homes. This isn’t just a piece of paper; it’s a power move. It shows sellers your financing is locked and loaded, making your offer far more reliable and attractive than one from a buyer who hasn’t taken this step.

While today’s buyer’s markets are cyclical, history shows us just how much leverage buyers can gain. During the Great Depression, for instance, a massive housing surplus and scarce financing created an extreme buyer’s market that lasted for years, causing property prices to plummet across the country, including in Dallas.

Use the Inspection to Your Advantage

The inspection is your moment to shine. A key part of your strategy is understanding what to look for when inspecting a residential property. In a buyer’s market, you don’t have to simply accept a home “as-is.” Use the inspection report to pinpoint necessary repairs and negotiate for seller-paid credits at closing.

Getting credits is often a smarter move than having the seller manage the repairs themselves. Why? Because it gives you total control over the quality of the work once the keys are in your hand. This tactic alone can save you a bundle in out-of-pocket costs.

For buyers focusing on specific areas, diving into the local real estate insights for investors in Lake Highlands can give you an even sharper edge. By combining a strong offer with savvy negotiation, you can turn these market conditions into a major financial win.

Of course. Here is the rewritten section, crafted to sound like it was written by an experienced human expert, following all the specified requirements.

Frequently Asked Questions About Buyer’s Markets

When the Dallas real estate market starts to shift, it’s natural to have questions. All the talk about what is a buyer’s market can be confusing, and you’re probably wondering how it really impacts your search for a home in North Texas.

Let’s clear the air. This section tackles the most common questions we hear from clients, giving you the straightforward answers you need to move forward with confidence and build a winning strategy.

How Long Do Buyer’s Markets Typically Last in Dallas?

That’s the million-dollar question, isn’t it? The truth is, there’s no set timeline. In a dynamic economy like the one we have here in Dallas, a buyer’s market could stick around for a few months or stretch out for a couple of years. It all comes down to broader economic factors that trickle down to our local scene.

A few key drivers really move the needle:

- Corporate Relocations: When a major company moves to DFW or expands its footprint, it can supercharge buyer demand and shorten the cycle almost overnight.

- Interest Rate Trends: National shifts in mortgage rates have a direct line to a buyer’s wallet, impacting purchasing power all across Dallas.

- New Construction: The sheer pace of new home building in suburbs like Frisco and Prosper can pump up inventory levels, which often extends a buyer’s market phase.

The smartest move isn’t trying to perfectly time the market’s bottom. Instead, focus on current indicators like inventory levels and days on market. A good agent who lives and breathes these Dallas-specific trends is your best bet for navigating it all.

Does a Buyer’s Market Mean Home Prices Will Crash?

Not necessarily, and in Dallas, a true price crash is pretty rare. What a buyer’s market usually means here is that the rapid, pedal-to-the-metal price growth we see in a seller’s market just cools off or stagnates.

Think of it less as a nosedive and more as a leveling-off. The real win for you as a buyer comes from having more homes to choose from, facing way less competition, and gaining a ton of negotiating leverage on both the price and the contract terms.

Can I Still Find a Good Deal in a Seller’s or Balanced Market?

Absolutely. Even when the overall Dallas market feels like it’s tilted in the sellers’ favor, there are always opportunities for a well-prepared homebuyer. The key is to look for value where others aren’t.

A savvy buyer can sniff out a deal by targeting homes that have been sitting on the market longer than the neighborhood average. Or, you can find sellers who are highly motivated to move quickly. In these situations, an agent who truly understands the unique submarkets from Lakewood to Plano is worth their weight in gold. They can uncover those hidden gems and negotiate effectively, no matter what the broader market is doing.

Ready to turn Dallas market conditions into your advantage? At Dustin Pitts REALTOR Dallas Real Estate Agent, we provide the expert guidance and deep local knowledge you need to succeed. Whether you’re buying or selling, we’re here to help you make your next move with confidence. Contact us today to get started!