In the fast-paced world of Dallas real estate, pricing a home can feel like a guessing game. But what if you could trade that guesswork for a solid, data-backed strategy? That’s exactly what a comparative market analysis (CMA) delivers.

A CMA is much more than a simple price estimate. It’s a deep dive into the hyper-local market, put together by a real estate professional to give you a clear, realistic picture of your property’s current worth. It’s hands-down one of the most powerful tools for making smart financial moves in the competitive Dallas-Fort Worth scene.

What a Comparative Market Analysis Really Means for Dallas Properties

Think of a CMA as the market holding up a mirror to your property. It’s not about what you feel your home is worth; it’s about what active, qualified buyers are willing to pay for a home like yours, in your Dallas neighborhood, right now. This report grounds your expectations in hard data, forming the bedrock of a successful pricing strategy.

Whether you’re selling or buying, this analysis is your guide. For sellers, a solid CMA helps you sidestep the biggest pricing mistakes: listing too high and watching your home languish on the market, or pricing too low and leaving money on the table. For buyers, it’s the key to making a competitive offer and negotiating from a position of strength. To see how this data comes to life, you can explore detailed market insights on iMarcGroup.com.

The Core Components of a Dallas CMA

To really grasp what a CMA is, you need to understand its three core ingredients. Each piece of the puzzle offers a different view of the market, and when you put them all together, you get a complete picture of where your property stands.

A CMA meticulously analyzes three types of properties:

- Recently Sold Properties: These are the gold standard. They show what buyers in your specific Dallas neighborhood, whether it’s Lakewood or Uptown, have actually paid for homes similar to yours within the last 3 to 6 months. This is proof of market value.

- Active Listings: This is your direct competition. Looking at homes currently for sale shows you how other sellers are pricing their properties. It gives you a sense of the available inventory, which directly influences how you should position your own home.

- Expired or Withdrawn Listings: These are cautionary tales. These are the homes that didn’t sell, often because they were priced too high for what the market would bear. They show you the price ceiling—the point where Dallas buyers said “no thanks.”

To make this clearer, let’s break down how each component informs the final analysis.

Core Components of a Dallas CMA at a Glance

| Component | What It Is | Why It Matters for Dallas Real Estate |

|---|---|---|

| Recently Sold Properties | Homes like yours that have closed in the last 3-6 months in the same area. | These are the most accurate reflection of true market value—what buyers are proven to pay. |

| Active Listings | Properties currently on the market that are direct competitors to your home. | This shows the current pricing landscape and helps you position your home competitively to attract buyers. |

| Expired/Withdrawn Listings | Homes that were listed but failed to sell and were taken off the market. | These properties act as a warning, showing what prices the market has already rejected. |

By weaving together these three threads—historical sales, current competition, and past pricing failures—a powerful narrative emerges.

A strong CMA doesn’t just look at one category; it synthesizes data from all three. This blend of historical sales, current competition, and past pricing failures creates a realistic and defensible valuation.

Ultimately, a CMA is what moves you from wishful thinking to a data-driven plan. It answers the single most important question for any Dallas property owner or homebuyer: “What is this home actually worth today?” With this playbook in hand, you’re ready to make one of the biggest financial decisions of your life with confidence.

How Property Valuation in Dallas Has Evolved

Figuring out what a home is worth in Dallas isn’t what it used to be. Not that long ago, pricing a home was often based on an agent’s gut feeling and maybe a thin folder of recent sales from the neighborhood. Today, that old-school, subjective approach has given way to the data-packed, highly precise comparative market analysis—a tool that is absolutely essential in modern Dallas real estate.

This shift couldn’t be more important, especially in a market as energetic as Dallas. Property values in fast-growing suburbs like Plano or Frisco can swing wildly based on a new corporate campus moving in, a major infrastructure project, or even subtle shifts in a neighborhood’s vibe. A gut feeling just can’t keep up with that pace. Only data can.

From Manual Estimates to Data-Driven Insights

The idea of comparing homes to find a price isn’t new, but how we do it has transformed completely. Before computers became a staple on every desk, a CMA was a painstaking manual job. An agent would physically pull a few comparable sales and lean heavily on their personal experience. It was tedious, to say the least.

But as technology and data collection ramped up in the early 2000s, the CMA became far more powerful. Fast forward to today, and big data analytics allow agents to build a comprehensive analysis using thousands of data points. In fact, an estimated 70-80% of agents now rely on CMAs as a cornerstone of their business. If you’re curious about how data is reshaping the industry, you can dig into research on the global real estate market for a bigger picture.

What used to be an educated guess is now a calculated, evidence-based conclusion. The modern CMA pulls from a firehose of information, including comprehensive MLS data, public records, and sophisticated analytical tools.

The change from instinct-based pricing to data-backed analysis represents the single most important advancement in property valuation. It provides a level of clarity and confidence that was previously impossible for Dallas buyers and sellers.

Empowering Clients Through Transparency

This evolution has been a game-changer for real estate agents and their clients alike. Instead of just being told a price and having to take it on faith, you can now see all the evidence laid out before you. A detailed CMA shows you the exact homes being used for comparison and breaks down the logic behind every price adjustment.

That transparency is crucial. For sellers, it builds trust and provides solid justification for the recommended list price. For buyers, it offers the firm ground needed to put in a confident offer. The modern CMA has turned property valuation from a mysterious art form into a clear, understandable science—making it an indispensable part of any deal in the Dallas market.

The Critical Factors That Shape a Dallas CMA

While the basic components of a comparative market analysis give us the starting framework, the real magic—and accuracy—comes from digging into the details that make a Dallas property unique. What separates a generic online estimate from a true, actionable valuation is the ability to look beyond simple metrics like square footage and bedroom count. After all, two homes that seem identical on paper can have wildly different values once you factor in the critical variables.

These factors paint the full picture, providing the essential context for a property’s specific place in the Dallas market. Getting a handle on these nuances is how you truly grasp what your home is worth in the eyes of a local buyer.

Location Within Dallas Is King

You’ve heard it a million times, but it’s the oldest rule in real estate for a reason. In a sprawling metroplex like Dallas, “location” means so much more than just the city. It’s about the specific neighborhood, the street, and sometimes even which side of the highway a property sits on.

A 3,000-square-foot home in the trendy, walkable Bishop Arts District will fetch a completely different price than a home of the exact same size in Far North Dallas. We have to consider proximity to major employment hubs, the reputation of the local school district, and access to lifestyle amenities like the Katy Trail or White Rock Lake. These all play a massive role.

Property Condition and Key Features

A property’s condition is a huge value driver, plain and simple. A home with a recently renovated kitchen full of high-end appliances will be valued much higher than a comparable home with a kitchen straight out of the 1980s. A proper CMA has to make careful financial adjustments for these tangible differences.

Certain features are also in high demand with Dallas buyers and can add serious value. These often include:

- Swimming Pools: In the Texas heat, a well-maintained pool is a highly desirable feature that buyers will pay a premium for.

- Renovated Spaces: Modern primary bathrooms and open-concept living areas are huge selling points that can transform a property’s appeal.

- Outdoor Living Areas: Buyers love seeing covered patios, outdoor kitchens, and professional landscaping—it extends the living space.

- Age and Upgrades: While the age of the home matters, crucial updates to big-ticket items like the roof, HVAC, and windows can easily offset concerns about an older property.

A well-executed CMA doesn’t just list these features; it assigns a specific monetary value to them based on local market data. For example, a new roof might add $15,000 in value, while an outdated bathroom could require a $10,000 negative adjustment.

Hyper-Local Market Dynamics

Finally, a truly insightful CMA drills down into the nitty-gritty statistics of a specific neighborhood or even a pocket within a zip code. National or city-wide trends are just too broad to be useful here. What really matters is what’s happening on the ground, right where the property is located.

This means looking at key metrics like:

- Average Days on Market (DOM): How fast are homes selling in this part of town? A low DOM points to a hot seller’s market.

- Inventory Levels: Is there a glut of homes for sale, or is it a tight market with a shortage of options? Low inventory almost always pushes prices up.

- List-to-Sale Price Ratio: Are homes selling at their asking price, or are sellers consistently having to negotiate down?

These hyper-local stats add the final, crucial layer of context. They tell the why behind the prices, allowing an agent to develop a pricing strategy that is perfectly in sync with the immediate market reality.

How a Professional DFW CMA Is Built Step by Step

Putting together a professional comparative market analysis isn’t just about a quick scan of online listings. It’s a methodical process. For a seasoned Dallas real estate expert, building a truly accurate CMA is a structured investigation that turns raw data into a precise valuation, designed to uncover a property’s real standing in the market.

This disciplined approach means every variable gets accounted for, giving you a rock-solid foundation for one of the biggest financial decisions you’ll ever make. The whole point is to gather the right evidence and know how to interpret it correctly.

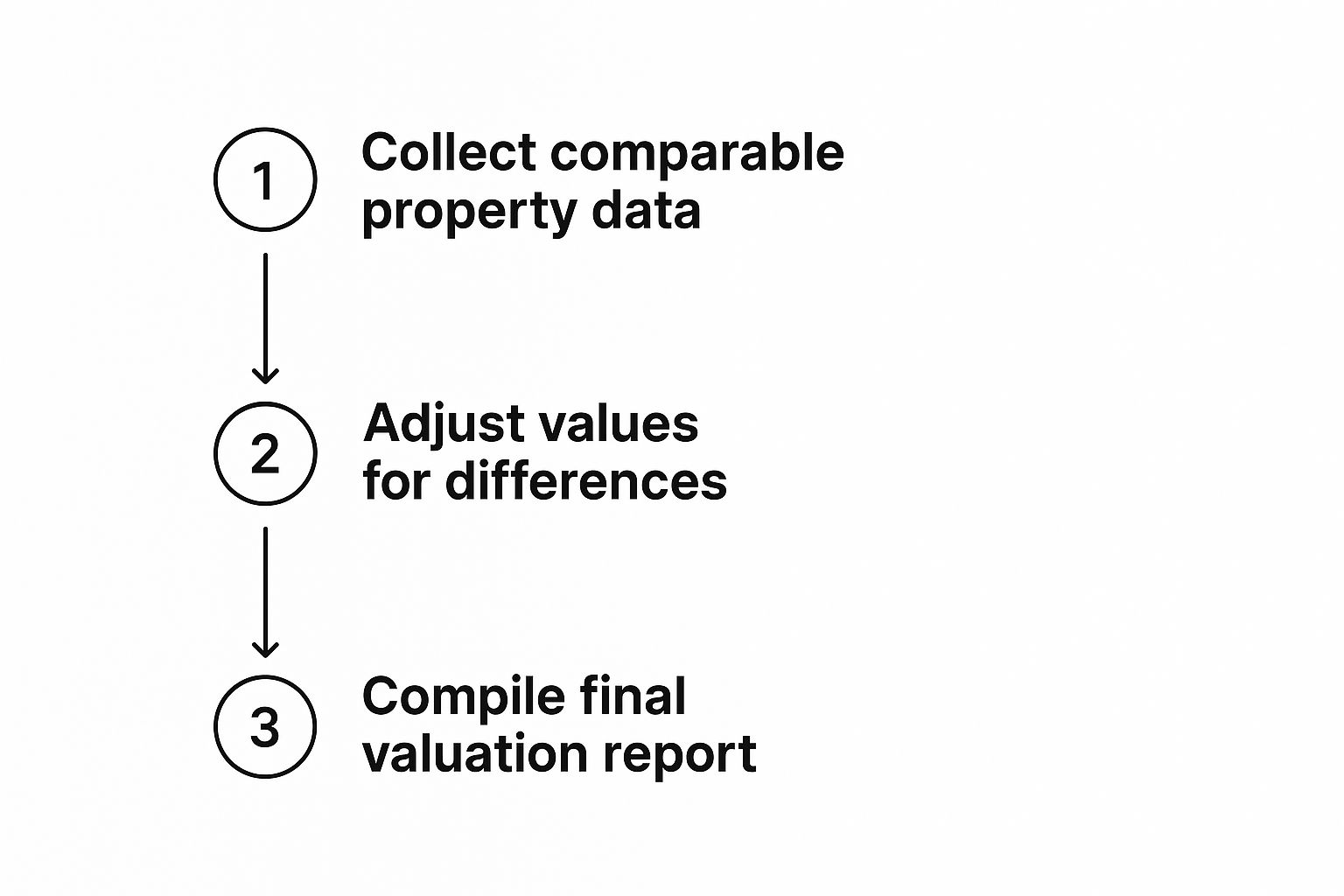

This infographic breaks down the core workflow into three key phases, showing how a reliable CMA comes to life.

As you can see, the process moves logically from collecting broad data to making specific value adjustments, all before landing on a final, detailed report. Let’s unpack what really happens at each stage.

Step 1: Profiling the Subject Property

First things first, we need to build a detailed profile of the subject property—that’s your home. This goes way beyond just the address. An agent will document every key attribute, from the exact square footage and the number of bedrooms and bathrooms to the home’s age, lot size, and any unique architectural details.

This initial profile also means noting the home’s overall condition, any recent upgrades (like a new HVAC or updated kitchen), and desirable extras like a pool or a three-car garage. Think of this as creating the benchmark that all other properties will be measured against.

Step 2: Finding the Best Comparable Properties

With the subject property’s profile locked in, the hunt for comparable properties, or “comps,” begins on the Multiple Listing Service (MLS). This is where local expertise becomes absolutely critical. A great agent isn’t just pulling homes in the same zip code; they’re digging deep within the very same neighborhood or a directly adjacent, similar one.

The goal is to find the closest possible matches from three distinct buckets:

- Recently Sold: Homes that sold in the last three to six months are the best evidence of true market value.

- Active Listings: This is your direct competition right now and shows current pricing strategies.

- Expired Listings: These are the homes that didn’t sell, often because they were overpriced. They help define the market’s price ceiling.

A professional CMA doesn’t just grab the first three comps that pop up. It’s a careful curation process, prioritizing properties with the most similarities in location, size, age, and condition to make sure the comparison is as direct and honest as possible.

Step 3: Making Adjustments and Finalizing the Value

Because no two homes are ever truly identical, the final step involves making strategic value adjustments. It’s a balancing act. If a comp has a beautifully renovated kitchen but your home doesn’t, the agent will subtract value from the comp’s sale price to even the playing field. On the flip side, if your home has a pool and the comp doesn’t, value gets added to its price.

This table gives a simplified look at how these adjustments work in practice. Imagine your home is in Lakewood, and we’re comparing it to a similar home that recently sold nearby.

CMA Adjustment Example for a Dallas Property

| Feature | Subject Property (Lakewood) | Comparable Property (Sold) | Adjustment Value | Adjusted Comp Price |

|---|---|---|---|---|

| Starting Price | $520,000 | $520,000 | ||

| Kitchen | Original | Recently Remodeled | -$15,000 | $505,000 |

| Pool | Yes | No | +$25,000 | $530,000 |

| Garage | 2-Car | 3-Car | -$5,000 | $525,000 |

| Final Adjusted Price | $525,000 |

After adjusting all the chosen comps this way, the agent analyzes the new prices to spot a clear value pattern. This detailed work leads to a specific, defensible price range—not just a single, pulled-from-thin-air number. This final figure represents a realistic market value for your home in the current Dallas real estate climate.

Using a CMA for a Strategic Advantage in Dallas

A comparative market analysis is so much more than just a pricing tool. Think of it as your strategic playbook, giving you a distinct advantage in any Dallas real estate deal.

Whether you’re selling a hot property or trying to buy in a competitive neighborhood, the data inside a CMA delivers the real-world proof you need to come out on top. For sellers, it’s about getting top dollar without sitting on the market for months. For buyers, it’s about making a smart, confident offer that gets noticed for all the right reasons.

How Sellers Gain a Competitive Edge

If you’re selling a home in sought-after areas like Richardson or Plano, setting the right price from day one is everything. A well-researched CMA is your roadmap to hitting that pricing sweet spot. It helps you dodge the two most common—and costly—mistakes: overpricing and underpricing.

An overpriced home just sits there, collecting dust and getting “stale” in the eyes of buyers. This almost always leads to price cuts down the road, which can make potential buyers suspicious. On the flip side, underpricing means you’re literally leaving money on the table—a painful thought in a market as strong as Dallas. A CMA gives you the hard evidence to price your home to draw in serious offers right out of the gate.

The right price, backed by solid data, creates a sense of urgency and value. It encourages multiple offers and puts you in a powerful negotiating position, which is critical for securing the best possible outcome.

How Buyers Secure a Better Deal

In the fast-moving Dallas market, it’s easy for buyers to feel the pressure, especially when bidding wars erupt in popular neighborhoods. A CMA acts as your anchor in reality. It equips you with the confidence to submit a strong, educated offer that’s based on facts, not just feelings. This signals to the seller that you’re a serious contender who has done their homework.

Even better, it gives you powerful negotiating leverage. Imagine a home has been lingering on the market for 60 days, while similar homes just down the street sold in less than two weeks. A buyer’s CMA would shine a spotlight on this, giving you a clear, data-backed reason for a lower offer. It changes the conversation from “I think it’s worth less” to “The data shows it’s worth less.”

This analytical approach is just as crucial after your offer is accepted. Before you close, a detailed walkthrough is essential to make sure the property’s condition aligns with the assumptions from your analysis. Our home walkthrough checklist is a thorough, practical guide to help you know exactly what to look for.

The information from a CMA can be a cornerstone of how you engage with potential buyers or sellers. To work more efficiently, many professionals now weave their CMA process into a broader real estate marketing automation strategy, making sure every conversation is timely and well-informed. By truly understanding and using the insights from a CMA, both buyers and sellers can navigate Dallas real estate with more clarity and hit their financial goals.

Understanding the Difference Between a CMA and an Appraisal

In the world of Dallas real estate, you’ll hear the terms comparative market analysis (CMA) and appraisal thrown around, sometimes as if they mean the same thing. They don’t. While both put a price on a property, they are fundamentally different tools used for completely different reasons. Getting this distinction right is crucial whether you’re buying or selling in the DFW area.

Here’s a simple way to think about it: a CMA is a real estate agent’s strategic game plan, while an appraisal is a lender’s formal audit. One is for competing in the market; the other is for securing a loan.

The Purpose of a CMA Versus an Appraisal

A CMA is a detailed report your real estate agent creates. Its main job is to help you, the seller, figure out the best possible listing price. For buyers, it helps in crafting a smart, competitive offer. It’s a tool rooted in current market activity—what’s selling, what isn’t, and for how much, right now, in a specific Dallas neighborhood. A CMA is all about market strategy.

An appraisal, on the other hand, is a formal, legally binding opinion of a home’s value, prepared by a state-licensed appraiser. A lender almost always requires one before they’ll approve a mortgage. The appraiser’s sole duty is to protect the bank’s investment, making sure the property is actually worth the loan amount.

A CMA answers the question: “What’s a competitive price for this home in today’s Dallas market?” An appraisal answers the question: “What is the official, defensible value of this home for financial and legal purposes?”

Why the Values Might Differ

It’s not unusual for an appraisal to come in at a different value than the price suggested by a CMA or even the final contract price. This is because appraisers operate under a very strict, standardized set of rules. They might use a different set of comparable properties or give more weight to certain features than an agent focused on market appeal would.

When an appraisal comes in low during a Dallas transaction, it can definitely put the deal in jeopardy. But you have options. It could lead to renegotiating the price, the buyer bringing more cash to the table to cover the gap, or even formally challenging the appraisal with solid data. Knowing how to navigate this is a critical part of the process.

To get a better handle on these potential hurdles, check out our complete guide on how to buy a house in Texas. Both the CMA and the appraisal are essential pieces of the puzzle, but understanding their distinct roles helps you manage expectations and stay in control of your transaction.

Common Questions About Dallas CMAs

Even after getting the rundown on what a comparative market analysis is, a few specific questions always seem to come up. Let’s tackle some of the most common things people ask when they’re thinking about buying or selling in the Dallas area.

How Accurate Is a CMA for a Unique Dallas Property?

This is a great question, especially in a city with such diverse architecture. For a one-of-a-kind property, like a historic home in Swiss Avenue or a completely custom modern build, the accuracy of a CMA really hinges on the agent’s boots-on-the-ground expertise.

Finding perfect, apples-to-apples comps can be nearly impossible. A truly skilled agent knows this and won’t just look at the raw numbers. They’ll make thoughtful, qualitative adjustments based on things like architectural significance, the home’s specific condition, and other singular features that a spreadsheet just can’t see. They often have to look at a broader set of properties to carefully triangulate an accurate value range.

Can I Do My Own Comparative Market Analysis?

While it’s tempting to rely on online estimators for a quick number, they simply can’t replace a professional CMA. Think of them as a ballpark guess. They use algorithms that scrape public data but lack the real-time MLS data and, more importantly, the nuance a local real estate expert provides.

These automated tools can’t see the stunning kitchen you just remodeled, the quirky layout that might turn some buyers off, or feel the true pulse of your specific Dallas neighborhood. When you’re making a financial decision this big, a professionally prepared CMA is always the more reliable path.

A professional’s analysis is crucial, especially for anyone making their first big move in the market. First-time buyers can gain critical insights from our guide on navigating the Dallas first-time home buyer process.

How Often Should a Dallas CMA Be Updated?

In a market as dynamic as Dallas, a CMA isn’t a “one and done” document. It’s a living snapshot of the market, and it needs to stay fresh.

For an active listing, a good rule of thumb is to refresh the CMA every 30 to 60 days. However, if there are major market shifts—like a sudden change in interest rates or a wave of new inventory hitting your specific area—it’s smart to update it even sooner. This keeps your pricing strategy sharp and responsive to what’s happening right now.

Navigating the Dallas market is all about having expert analysis and deep local knowledge in your corner. At Dustin Pitts REALTOR Dallas Real Estate Agent, we deliver the detailed CMAs and strategic guidance you need to hit your real estate goals. Let’s talk about your property’s true market value today. Visit us at https://dustinpitts.com.