When you’re diving into the Dallas real estate market, you’re going to come across a mountain of paperwork. But there’s one document that stands above the rest in importance: the deed of trust.

So, what is it? Put simply, a deed of trust is a legal agreement used here in Texas to secure a loan for a property. It’s often confused with a mortgage, but it’s a totally different animal. It’s a three-party contract designed to protect the lender until you’ve paid off every last penny of your loan.

Understanding Your Deed of Trust in a Dallas Property Deal

Think of a deed of trust as a safety net for your lender. When you buy a property in Dallas, this document gives the lender a solid security interest in your new house. It’s the key reason Texas is known as a “deed of trust state.”

This setup allows the whole transaction to move forward because it gives the lender a clear, established path to get their investment back if, for some reason, the loan isn’t repaid.

Unlike a simple IOU between two people, a deed of trust involves three key players, and each one has a specific, crucial role. Getting a handle on who these parties are is the first step to really understanding how your property purchase is structured.

The Three Parties Involved

Every single deed of trust in a Dallas transaction needs this trio to work. Without all three, the agreement just isn’t valid.

To make it crystal clear, here’s a quick breakdown of who’s who at the closing table.

The Three Key Parties in a Dallas Deed of Trust

| Party | Role (Who They Are) | Responsibility |

|---|---|---|

| The Trustor | You, the property buyer. | You grant a temporary, conditional title to the trustee to secure the loan. |

| The Beneficiary | Your lender (the bank). | They are the “beneficiary” of the agreement, as it protects their money. |

| The Trustee | A neutral third party. | Often a title company, they hold the property title “in trust” until the loan is paid off. |

This three-party structure is what really sets a deed of trust apart from a traditional two-party mortgage.

The trustee is the impartial middleman. They hold onto the title, making sure both you and the lender stick to the terms of the deal.

This arrangement is a core part of the entire property-buying journey in Texas. By understanding these roles, you’ll feel much more confident at every stage of the process.

For a complete rundown of everything that happens from start to finish, our comprehensive home buying process checklist is an invaluable guide. Think of the deed of trust as the foundational security instrument in any Dallas property deal—it’s what makes it all possible.

How a Deed of Trust Works From Closing to Payoff

That moment you sign the final papers on closing day for your new Dallas property is really just the start of your deed of trust’s journey. This document has a clear lifecycle, and it maps out the entire relationship between you, your lender, and the trustee until that very last mortgage payment is made.

It all kicks off when you, as the Trustor, grant what’s known as a “bare legal title” to the trustee.

That term sounds way more complicated than it is. It absolutely does not mean the trustee owns your property. Think of it more like they’re temporarily holding a limited, placeholder right to the title—acting as a neutral third party just to secure the loan for the lender.

As soon as it’s signed, the deed of trust gets filed and officially recorded down at the Dallas County Clerk’s office. This is a critical step. It creates a public record, putting everyone on notice that there’s a lien on your property. This public declaration is a core function of the deed of trust, protecting your lender’s financial stake against any other claims that might pop up.

The Lifecycle of Your Deed of Trust

For the next 15 or 30 years, as you faithfully make your monthly payments, the deed of trust pretty much sits quietly in the background. The trustee’s job is completely passive during this phase. They’re simply on standby, waiting for one of two things to happen: you pay off the loan completely, or the lender notifies them you’ve defaulted. Your steady payments are what keep everything moving toward the happy ending.

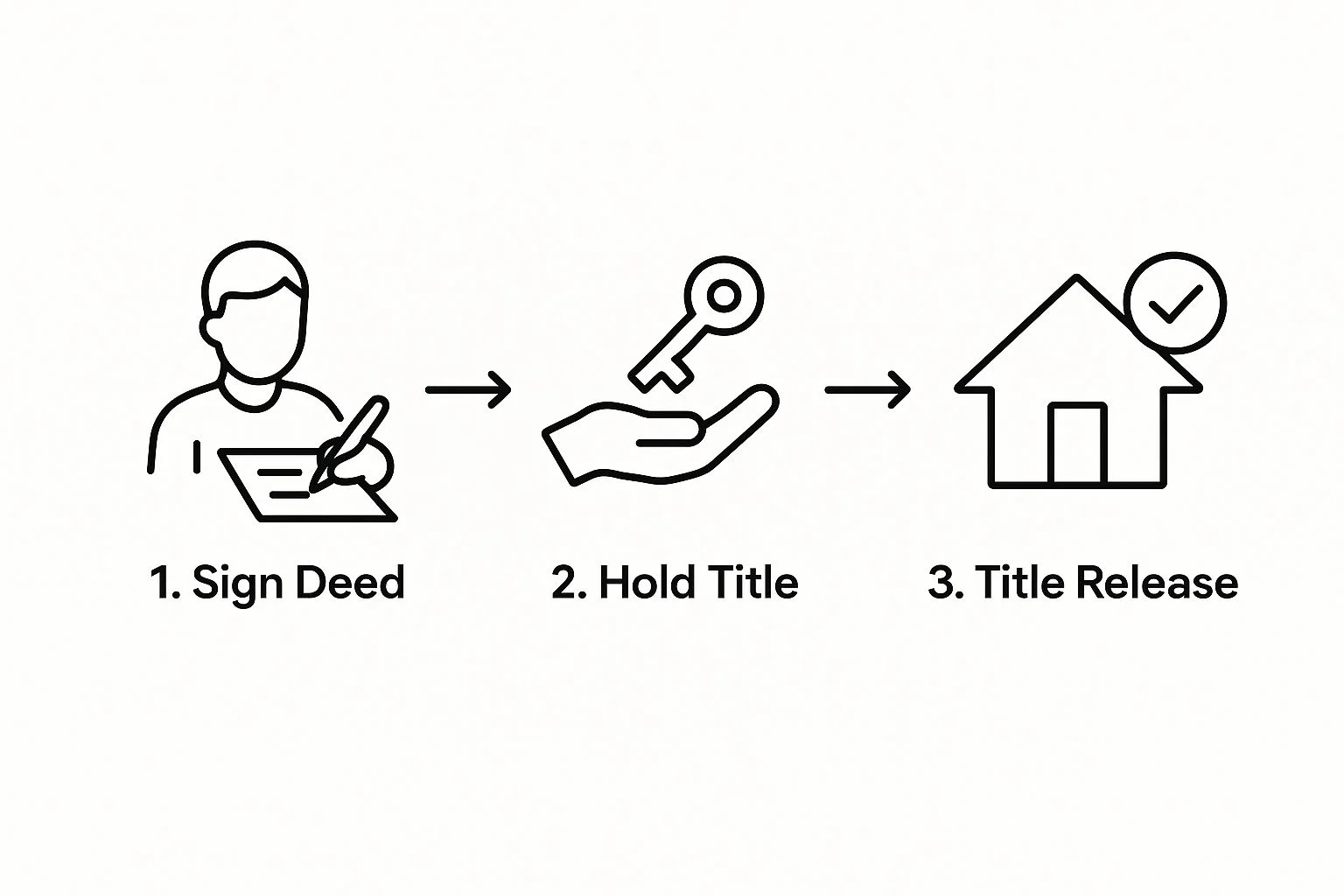

This infographic breaks down the simple, three-step journey of a deed of trust from the day it’s signed to the day it’s released.

As you can see, the trustee’s role is temporary by design. They only hold that bare title as long as the loan is active. The minute it’s paid, their job is to hand it right back to you.

Reaching the Finish Line: The Deed of Reconveyance

The final step is easily the most rewarding part of the whole process. Once you’ve made that final loan payment, the lender (the Beneficiary) gives the trustee the green light to close out the agreement. The trustee then draws up and records a document called a Deed of Reconveyance.

This document officially wipes the lien off your property. It “reconveys” that bare legal title from the trustee back to you, the property owner. You’re left with a clean, unencumbered title.

This final action is the official proof that you’ve met all your loan obligations and you are the one and only, undisputed owner of your Dallas property. The deed of trust has done its job.

This whole system is standard practice not just in Texas but in at least 20 other states, too. It really comes down to regional preferences for how real estate loans are secured. If you’re curious, you can dig deeper into the regional usage of these documents and how they are publicly recorded to see how it works in other parts of the country.

Deed of Trust vs Mortgage: The Key Texas Differences

You’ll hear people use “mortgage” and “deed of trust” like they’re the same thing, but in Texas, they’re worlds apart. For any Dallas property buyer, understanding this distinction isn’t just trivia—it’s critical.

The entire difference really comes down to one powerful word: foreclosure. How that process unfolds is dramatically different between the two, and it shapes the rights of both borrowers and lenders if payments ever stop. This isn’t just a legal technicality; it’s the foundation of real estate law in our state.

Power of Sale and the Foreclosure Process

The game-changer in a Texas deed of trust is a clause called the power of sale. This little bit of text gives the trustee the authority to sell the property if you default on the loan, and—this is the important part—they can do it without ever stepping foot in a courtroom.

- Non-Judicial Foreclosure (Deed of Trust): This is the Texas way. The process happens outside the court system, making it incredibly fast and much less expensive for the lender. The trustee simply follows the steps laid out in state law to foreclose and sell the property.

- Judicial Foreclosure (Mortgage): With a traditional mortgage, a lender has to sue the borrower. They must go to court and get a judge’s permission to foreclose, which turns into a drawn-out, costly, and very public legal fight that can drag on for months, if not years.

Because Texas law allows for non-judicial foreclosure, the timeline from a missed payment to losing the property can be terrifyingly fast—sometimes as little as 60 to 90 days.

This fast-track process gives lenders a ton of security, which is why they prefer it. But it puts all the responsibility on Dallas property owners to stay on top of their payments. If you’re just starting out, getting a firm handle on all your costs is non-negotiable. Our guide on what a first-time buyer down payment really looks like in Dallas is a great place to start.

A Clear Comparison for Dallas Buyers

Let’s lay it all out. Seeing the differences side-by-side makes it crystal clear why Texas operates the way it does. The way the title is handled and the number of people involved are completely different, leading to vastly different outcomes.

Here’s a simple table to break down the key points.

Deed of Trust vs Mortgage: A Texas Comparison

| Feature | Deed of Trust (Texas Standard) | Mortgage (Less Common in Texas) |

|---|---|---|

| Number of Parties | Three (Trustor, Beneficiary, Trustee) | Two (Mortgagor/Borrower, Mortgagee/Lender) |

| Title Handling | Trustee holds a “bare legal title” | Borrower holds the title, but lender has a lien |

| Foreclosure Type | Non-judicial (faster, no court required) | Judicial (requires a lawsuit and court order) |

At the end of the day, the deed of trust reigns supreme in Texas for a reason. Its efficiency and the clear, predictable framework it provides are exactly what lenders want, cementing its role as the backbone of real estate financing in Dallas and across the entire state.

The Critical Role of the Trustee in Your Transaction

In any Dallas real estate deal using a deed of trust, there’s a quiet but powerful player working behind the scenes: the Trustee. Think of them as the impartial referee of the entire agreement.

This neutral third party, usually a title company or an attorney here in Dallas, doesn’t really do much for most of your loan’s life. Their job is simply to hold that “bare legal title” we talked about earlier. They’re just a placeholder, securing the loan for the lender while you go about your life as a property owner.

The Trustee only steps onto the field in two very specific—and opposite—scenarios. Getting a handle on these moments is the key to understanding why a deed of trust works so well for both borrowers and lenders.

When the Trustee Springs into Action

The Trustee can’t just act on a whim. Their duties are strictly defined by the deed of trust itself and by Texas law, ensuring a fair and predictable process no matter what happens.

Essentially, they’re activated by one of two triggers that bookend the loan’s journey: a successful payoff or a serious default.

- When You Pay Off the Loan: Congratulations! You’ve made your final payment. The lender (the Beneficiary) gives the Trustee the green light to release the title. The Trustee then drafts and files a document called a Deed of Reconveyance. This officially wipes the lender’s lien off your property records and hands you the full, clear title. Mission accomplished.

- When the Loan Goes into Default: On the flip side, if you stop making payments, the lender can instruct the Trustee to kick off the foreclosure process. This gives the Trustee the legal power to manage a non-judicial foreclosure on the lender’s behalf.

The Trustee’s dual function—releasing the title upon payoff or foreclosing upon default—is the core mechanism that makes the deed of trust such a reliable and efficient tool for financing real estate in Dallas.

The Power to Foreclose

This is where the Trustee’s role becomes most critical. Their authority to sell a property at a foreclosure auction without needing a court order is what makes a deed of trust so different from a traditional mortgage.

If the lender gives the directive, the Trustee is legally bound to follow the strict steps required in Texas. This isn’t a loose process; it involves sending official notices, publicly posting the sale, and conducting the auction, which typically happens on the Dallas County courthouse steps.

This power provides lenders with significant security because it’s a much faster and more straightforward process than going through the courts. For property owners, it highlights just how serious and swift the consequences of default can be under a Texas deed of trust. The Trustee’s job is to make sure this entire process unfolds exactly as the law requires, protecting the integrity of the original agreement.

Navigating Foreclosure Under a Texas Deed of Trust

While no one ever wants to think about it, understanding the foreclosure process is a crucial part of grasping how a deed of trust really works here in Texas. The way this process is structured is the very reason why lenders in Dallas County overwhelmingly prefer it to a traditional mortgage.

It all boils down to a powerful feature called the “power of sale” clause. This one clause is the key that unlocks non-judicial foreclosure.

What does that mean for you? It means the lender can foreclose on the property without having to go to court. This makes the entire process incredibly fast and far less expensive for the lender. For the property owner, it means a default can escalate to a foreclosure auction with alarming speed.

The Non-Judicial Foreclosure Timeline

The Texas Property Code lays out a very specific, strict sequence of events that the lender and trustee absolutely must follow. This isn’t a loose guideline; it’s a step-by-step procedure designed for one thing: efficiency.

The first domino to fall is a formal Notice of Default and Intent to Accelerate. This is a letter sent to the borrower giving them a chance to fix the problem—typically 20 days—by catching up on any missed payments.

If the borrower can’t resolve the default in that window, the lender “accelerates” the loan, demanding the entire balance be paid in full immediately.

After that, the trustee issues a Notice of Sale at least 21 days before the scheduled auction date. This notice has to be publicly available and is:

- Posted at the door of the Dallas County courthouse.

- Filed with the Dallas County Clerk.

- Sent via certified mail to the borrower’s last known address.

This mandatory 21-day notice period is a critical protection for the property owner, but it also highlights just how urgent the situation is. The foreclosure sale itself is a public auction, usually held on the first Tuesday of the month, right on the steps of the Dallas County courthouse.

Understanding the Bottom Line

For any Dallas property owner, the biggest takeaway here is the sheer speed of this process. From the moment you miss a payment and trigger a default, the property can be sold at auction in just a couple of months. It’s a sobering reminder of the serious responsibility that comes with signing a deed of trust.

This system gives lenders strong protection, which in turn helps keep capital flowing and the local real estate market active. For borrowers, it’s a crystal-clear signal of how important it is to stay on top of payments.

Keep in mind that different loan programs can have their own specific rules. Understanding the fine print of your financing, like the obligations detailed in these FHA loan requirements in Texas, is always a smart move. In the end, the deed of trust reinforces just how vital financial preparedness is for every property owner in Dallas.

Got Questions About Dallas Deeds of Trust?

Even after getting the basics down, you’ll probably still have a few questions pop up, especially when it comes to your specific situation in Dallas. Let’s tackle some of the most common ones I hear from clients.

Can I Sell My Dallas Property With an Active Deed of Trust?

Absolutely, yes. Having a deed of trust doesn’t stop you from selling your property. What happens is pretty straightforward: the money from the sale is used to pay off the remaining balance on your loan first.

Your closing agent—almost always a title company here in Dallas—handles all the moving parts. They make sure your lender gets paid in full. Once the lender confirms they’ve received the funds, they instruct the Trustee to issue and record a Deed of Reconveyance. This little document is a big deal; it officially clears the lien from your property’s title, leaving it free and clear for the new owner.

What’s the Difference Between a Deed and a Deed of Trust?

This is easily one of the most common points of confusion, so let’s clear it up.

A deed (in Texas, typically a General Warranty Deed) is the document that actually transfers ownership of the property from the seller to you. It’s the paper that says, “Congratulations, you own this property now.”

A deed of trust, on the other hand, doesn’t transfer ownership at all. Think of it as a security agreement. It places a lien on your property, using it as collateral to secure the loan you took out. At your Dallas closing, you’ll sign both: you get the deed that makes you the owner, and you sign the deed of trust that reassures your lender.

The simple way to remember it: The deed gives you the property, and the deed of trust secures the loan that made it possible.

Who Picks the Trustee in a Dallas Transaction?

The lender (the Beneficiary) is the one who chooses the Trustee. Here in the Dallas market, this role is usually filled by a title company, a real estate attorney, or sometimes a corporate entity connected to the lender itself.

But here’s the key thing to remember: even though the lender picks them, the Trustee has a strict legal duty to be a neutral third party. Their job is to act impartially and simply follow the rules laid out in the deed of trust, protecting the interests of both you and your lender.

If you want to dig into more general real estate topics, you might find some useful information in these additional frequently asked questions about real estate.

Whether you’re buying your first condo in Uptown or selling a luxury estate in Preston Hollow, understanding the ins and outs of a deed of trust is non-negotiable. For expert guidance tailored to the Dallas market, contact Dustin Pitts REALTOR Dallas Real Estate Agent to ensure your transaction is handled with clarity and professionalism. Visit us at https://dustinpitts.com to get started.