Before you even think about applying for a mortgage in Dallas, there’s a number you absolutely need to know: your debt-to-income ratio, or DTI. Think of it as a financial stress test. Lenders use this simple percentage to see how your monthly debts stack up against your monthly income.

This one number tells them a crucial story: can you realistically handle a new mortgage payment on top of everything else you already owe? It’s their go-to metric for gauging your financial health.

Understanding Debt-to-Income Ratio in Dallas

For a Dallas mortgage lender, your DTI is a quick financial snapshot. It paints a clear, immediate picture of your monthly obligations versus what you bring in. Lenders use it to assess their risk in lending to you. Essentially, they’re trying to figure out if adding a Dallas-sized mortgage payment would push your budget to its breaking point.

To really get a handle on DTI, you first need a solid picture of your overall finances. A great starting point is understanding foundational financial statements, since these documents are where the income and debt figures for your ratio come from. When Dallas lenders dive into your application, they’re actually calculating two different types of DTI.

Two Sides of Your Financial Story

Lenders look at your finances from a couple of different angles to get the full picture. These two ratios give them different, but equally important, insights into how well you can manage your housing costs and your total debt load.

- Front-End DTI: This number focuses only on your potential housing costs. It’s the percentage of your gross monthly income that would go toward your mortgage payment, property taxes, and homeowners insurance right here in Dallas. It’s all about the house.

- Back-End DTI: This is the big one—the all-encompassing ratio. It takes your proposed mortgage payment and adds all your other monthly debts to the pile. We’re talking car loans, student debt, credit card minimums, the works. It then compares that grand total to your gross monthly income.

For example, let’s say your proposed mortgage payment in Dallas is $2,500 and your gross monthly income is $10,000. Your front-end DTI would be a solid 25%. Now, add in a $500 car payment and $300 in other loan payments. Your total monthly debt is now $3,300, which makes your back-end DTI 33%.

Getting a firm grip on both of these figures is one of the smartest moves you can make in the competitive Dallas real estate market. When you understand and manage your DTI, you’re putting yourself in the driver’s seat of your home-buying journey.

Quick Guide to DTI Ratios for Dallas Homebuyers

To make things even clearer, here’s a quick breakdown of what these DTI percentages typically mean to a lender when you’re looking for a home in Dallas.

| DTI Ratio Percentage | Lender’s Perspective | Typical Loan Eligibility in Dallas |

|---|---|---|

| 36% or Less | Ideal Candidate: You have a lot of flexibility in your budget after paying your bills. This is the sweet spot. | You’ll likely qualify for the best loan programs with the most competitive interest rates. |

| 37% to 43% | Generally Acceptable: This is a common range for many homebuyers. Lenders see this as manageable. | You should still have access to most conventional and government-backed loan options in Dallas. |

| 44% to 50% | Higher Risk: Lenders will look more closely at your application. Strong credit or a large down payment might be needed. | You may be limited to specific loan types, like FHA or VA loans, which can be more flexible. |

| Over 50% | Very High Risk: It’s tough to get approved at this level. Lenders worry you won’t have enough cash for other expenses. | Mortgage approval is unlikely. You’ll need to focus on paying down debt or increasing income. |

This table is a great reference, but remember every Dallas lender has slightly different rules. The key is to know where you stand before you start your search for that perfect Dallas home.

How to Calculate Your DTI for a Dallas Home Loan

Before you even start chatting with a Dallas lender, calculating your debt-to-income ratio is a game-changing first step. The formula itself is pretty simple, but the real key is knowing exactly which numbers to plug in. Going through this process lets you see your own finances through a lender’s eyes.

The basic formula is your total monthly debt payments divided by your gross monthly income. Gross income is your paycheck before Uncle Sam and anyone else takes a cut. For the debt side of the equation, lenders are looking at recurring monthly payments—think student loans, car payments, and the minimum payments due on your credit cards.

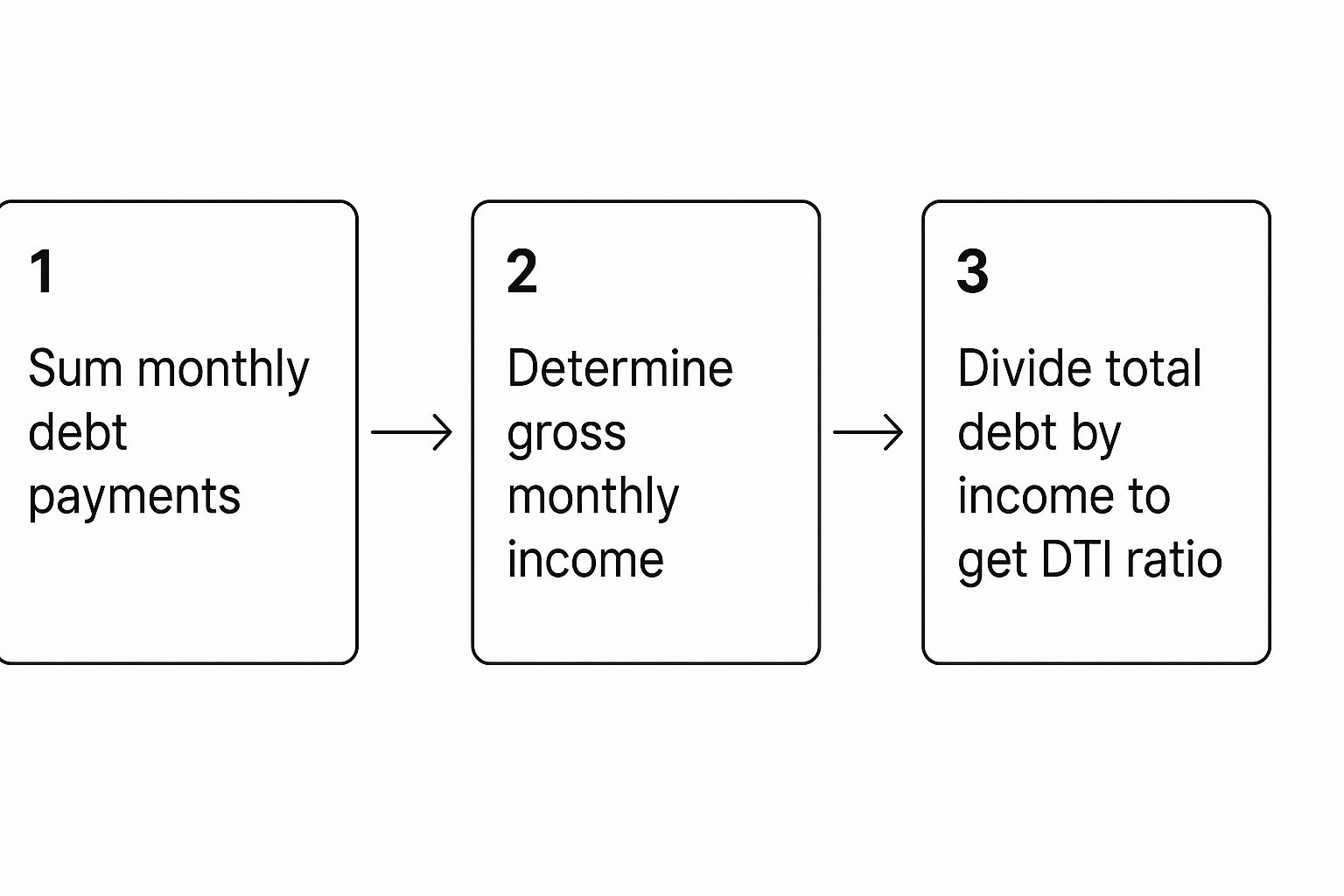

This little infographic breaks down the math into three easy steps.

As you can tell, once you have all your financial figures in front of you, figuring out your DTI is just a matter of simple arithmetic.

A Dallas Calculation Example

Let’s put this into a real-world Dallas context. Imagine a professional working in the city’s booming tech scene. Here’s a snapshot of their finances:

- Gross Monthly Income: $8,000

- Monthly Car Payment: $500

- Student Loan Payment: $400

- Credit Card Minimum Payments: $150

First, we’ll add up all the monthly debts: $500 + $400 + $150 = $1,050.

Next, we divide that total debt by the gross monthly income: $1,050 / $8,000 = 0.13125. To turn that into a percentage, just multiply by 100. That gives us a DTI of 13.1%.

A DTI this low puts our Dallas tech professional in a fantastic position for getting pre-approved for a mortgage. As you prepare, it’s also smart to look at all your financing options, because how you compare fixed rate mortgages, for example, can also play a role in your overall financial picture.

This DTI number isn’t just a local thing; it’s a critical metric used by lenders everywhere to gauge your ability to handle monthly payments. Within the Dallas mortgage industry, and across the U.S., financial regulators generally like to see a DTI below 36%. It’s a widely accepted benchmark for determining creditworthiness and the risk of default, which is why lenders focus on it so heavily.

Why Dallas Lenders Focus Heavily on DTI

For any Dallas mortgage lender, your debt-to-income ratio is much more than just a number on a form—it’s their single best tool for gauging risk. Think of it as a financial stress test. It helps them predict how well you can handle a long-term mortgage payment, especially with the unexpected costs that can pop up here in North Texas.

A high DTI sends a clear signal to an underwriter that your budget might already be stretched a little too thin. They know all too well that a surprise property tax hike in Dallas County or a major AC repair during a brutal summer could make it tough to keep up with payments. Lenders aren’t just looking at your financial past; they’re trying to get a clear picture of your future stability in Dallas.

DTI Thresholds for Dallas Home Loans

It’s important to know that different loan programs, especially those popular here in Texas, have their own specific DTI benchmarks. Understanding these limits is the first step in figuring out which mortgage options are truly on the table for you.

- Conventional Loans: These are the workhorses of the mortgage world. Lenders in Dallas typically look for a back-end DTI of 43% or less. In some cases, they might stretch up to 50% if you have other strong financial factors in your favor.

- FHA Loans: Because they’re backed by the government, FHA loans tend to offer a bit more flexibility. A Dallas lender might approve a DTI up to 43%, and sometimes even higher, if the rest of your application is rock-solid.

- VA Loans: Created for service members and veterans, VA guidelines are known for being more generous. While there isn’t a hard-and-fast maximum DTI, most Dallas VA lenders use a ratio around 41% as a general guideline.

A strong loan application is about more than just your debt-to-income ratio. Dallas lenders will also look at “compensating factors” that can help balance out a higher DTI. These are things that prove you’re a reliable borrower, even with a tighter monthly budget.

Things like a substantial down payment, an excellent credit score, or significant cash reserves can make a lender feel much more comfortable with a DTI that’s a little over the standard limits. These factors show you have strong financial discipline and ultimately reduce the lender’s risk, which could open up better borrowing opportunities for you in Dallas.

How Dallas Living Costs Impact Your Financial Picture

Your debt-to-income ratio is a critical number, but on its own, it doesn’t paint the complete picture of your financial life here in Dallas. The DTI formula is pretty straightforward—it’s all about debt versus income. But the high cost of living in North Texas adds another, unofficial layer that Dallas lenders absolutely pay attention to.

Think about it: expenses like property taxes, homeowners insurance, and your daily commute aren’t technically “debts.” They won’t show up in your DTI calculation. Still, they definitely take a big bite out of your monthly budget.

Lenders in Dallas are keenly aware of these local economic pressures. They know that whatever money you have left after paying your core debts has to stretch to cover the expensive reality of living in DFW. This is precisely why a healthy DTI is so important. It gives you the financial cushion to handle these non-debt expenses without feeling squeezed.

Beyond the DTI Formula

Let’s look at a few major expenses that hit your budget every month in Dallas but aren’t part of the DTI formula:

- Property Taxes: Dallas County property taxes are no joke and can add a hefty sum to your monthly housing payment.

- Transportation: In the sprawling DFW metroplex, the costs of getting around—gas, tolls, and vehicle upkeep—are a significant and unavoidable expense.

- Utilities: Just keeping a home cool during a Texas summer is a major, often fluctuating, line item in any Dallas budget.

These costs are all competing for the same dollars you’ll be using to pay your mortgage. A low DTI signals to lenders that you have the breathing room to manage not only your debts but also the unique, and often high, costs of living in Dallas.

For a clearer idea of what to expect, you can dig into a more detailed breakdown of the living costs in Dallas.

Getting your DTI in good shape is about more than just getting a loan approved. It’s about setting yourself up for long-term financial stability so you can actually thrive—not just survive—as a homeowner in this dynamic city. Dallas lenders are cautious because they’ve seen how quickly a budget can get strained.

How To Improve Your DTI And Get Approved

If your debt-to-income ratio is a bit higher than you’d like, don’t sweat it. The good news is that you’re in the driver’s seat. Knocking that number down is one of the most direct ways to beef up your mortgage application and boost your buying power, especially in a hot market like Dallas.

Think of it as a two-part mission: systematically shrinking your monthly debt payments while making sure every penny of your income gets counted.

When you take smart, deliberate steps to lower your DTI, you’re not just showing Dallas lenders you’re a responsible borrower. More importantly, you’re creating some much-needed breathing room in your own budget. A lower ratio makes you a five-star applicant and sets you up for better financial health long after you get the keys to your new Dallas home. Let’s dig into some real-world strategies you can put into play today.

Attack The Debt Side Of The Equation

The quickest way to see a real change in your DTI is to tackle the “debt” part of the formula head-on. This means strategically paying down what you owe to lower those monthly minimums.

- Go After High-Interest Debt First: Funnel any extra cash toward credit cards or personal loans with the highest interest rates. This is often called the “avalanche method,” and it’s a powerhouse for saving money over the long haul while quickly chipping away at your monthly obligations.

- Knock Out Small Balances: Got a few small, annoying loans with only a handful of payments left? Pay them off completely. Wiping a monthly payment off the books—no matter how small—gives your DTI an immediate drop.

- Look into Debt Consolidation: Rolling several high-interest debts into a single, new loan with a lower rate can seriously reduce your total monthly payment. It not only simplifies your bills but can give your DTI some instant relief.

Getting your debt under control is a non-negotiable step before buying a home in Dallas. It’s one of the most critical things you need to know when buying a home in Dallas, as it has a massive impact on whether you get approved.

Maximize The Income Side Of The Equation

The other half of the DTI puzzle is your gross monthly income. Making sure every dollar you earn is properly documented is just as vital as paying down debt. Lenders need to see a steady, provable income history.

If you have a more complex financial picture—maybe you’re self-employed or have outstanding tax issues—it’s crucial to get everything squared away. For example, resolving a significant tax liability can make a huge difference. You can find an excellent complete guide to tax debt settlement that walks through the specific steps. By proactively polishing every part of your financial profile, you’ll walk into a Dallas lender’s office with the strongest application possible.

Action Plan To Lower Your DTI Ratio

Deciding how to tackle your DTI depends on your specific financial situation and timeline for buying in Dallas. Some methods offer quick wins, while others are more of a long-term play. This table breaks down a few common strategies to help you decide which path is right for you.

| Strategy | Impact on DTI | Typical Timeframe | Best For… |

|---|---|---|---|

| Pay Down Balances | High | 1-6 Months | Borrowers in Dallas with extra cash flow who can make aggressive extra payments on credit cards or loans. |

| Debt Consolidation | Medium to High | 1-2 Months | People with multiple high-interest debts who can qualify for a new loan with a lower monthly payment. |

| Increase Income | High | 3-12+ Months | Those who can take on a side hustle, get a raise, or have bonuses that can be documented over time. |

| Correct Credit Report Errors | Variable | 1-3 Months | Anyone who finds inaccurate accounts or balances on their credit report that are inflating their debt. |

Each of these approaches has its merits. The key is to create a plan you can stick to. Even small, consistent efforts can lead to a significant drop in your DTI ratio, putting you in a much stronger position to buy your dream home in Dallas.

Common DTI Questions for Dallas Homebuyers

Working through the Dallas real estate market always kicks up a few key questions about debt-to-income ratio, especially when your financial life isn’t perfectly straightforward. Getting good answers to these questions can take a huge weight off your shoulders during the mortgage process, giving you the confidence to move forward.

Let’s break down some of the most common DTI questions I hear from Dallas homebuyers.

Does My Spouse’s Debt Count in Texas?

This is a big point of confusion, and the answer is absolutely critical for anyone buying a home in Dallas. Because Texas is a community property state, a lender will almost always consider your spouse’s debts as a shared responsibility, even if their name isn’t on the mortgage application with you.

That means their student loan, car payment, or credit card debt gets factored right into your DTI calculation. You absolutely need to have a frank conversation with a Dallas mortgage pro about your combined financial picture to see exactly how this will play out for your final ratio.

What Is a Good DTI for an FHA Loan in Dallas?

FHA loans are a fantastic option for many homebuyers here in Dallas, largely because they’re so flexible. As a general rule, Dallas lenders want to see a DTI ratio below 43% for an FHA loan.

But here’s the good news: the guidelines can be surprisingly forgiving. It’s not unheard of for lenders to approve a DTI as high as 50% if you have strong “compensating factors” to back it up. These are things that show you’re a solid borrower, like:

- A great credit score

- A healthy amount of cash reserves in the bank

- A down payment that’s larger than the minimum requirement

These elements prove you have financial stability, which can help a lender feel more comfortable with a higher DTI and get you across the finish line on a Dallas property.

A common mistake is assuming that a minor financial detail won’t matter. But in the world of mortgages, everything from a spouse’s old student loan to a small personal loan can impact your DTI and, ultimately, your ability to secure financing for your Dallas home.

Will Paying Off a Small Loan Before Applying Help?

Yes, without a doubt. This is one of the quickest and most effective ways to give your DTI a boost. When you pay off a smaller debt—like a personal loan or a credit card with just a little left on it—and close the account, that monthly payment is immediately wiped from your debt calculation.

Just make sure the account is officially reported as paid and closed on your credit report before you submit your mortgage application. Taking smart, proactive steps like this is a great strategy, but be careful to avoid common first-time homebuyer mistakes in Dallas like opening new credit cards or financing a car during this crucial time.

When you’re ready to take the next step in your Dallas home search, having an expert on your side makes all the difference. The team at Dustin Pitts REALTOR Dallas Real Estate Agent is here to provide the local knowledge and professional guidance you need to navigate every aspect of the process, from understanding your DTI to closing on your perfect home. Visit us online at https://dustinpitts.com to get started.