In the Dallas real estate world, your house is so much more than just a place to live—it’s a powerful financial tool. So, what is real estate equity? Simply put, it’s the portion of your property you actually own. Think of it as your ownership stake, free and clear of what the bank is owed.

Your Stake in the Dallas Real Estate Market

Getting a handle on equity is one of the most important things you can do as a Dallas property owner. It’s the real-world difference between what your home could sell for today and the remaining balance on your mortgage. This number isn’t just for spreadsheets; it represents your true financial interest in the property.

Imagine your Dallas home is like a small business you’ve invested in. Your mortgage is the business loan, and your equity is your share of the company. As you pay down that loan or as the business’s value (your property’s value) goes up, your slice of the pie gets bigger.

This is especially critical in a market as dynamic as Dallas. The constant growth and development, from the bustling streets of Uptown to the expanding suburbs of Plano, can have a huge impact on property values and, in turn, your equity.

Why Equity Matters for Dallas Owners

For most property owners, building equity is the primary way they build wealth. It’s not just an abstract number on a statement; it’s a tangible asset you can put to work.

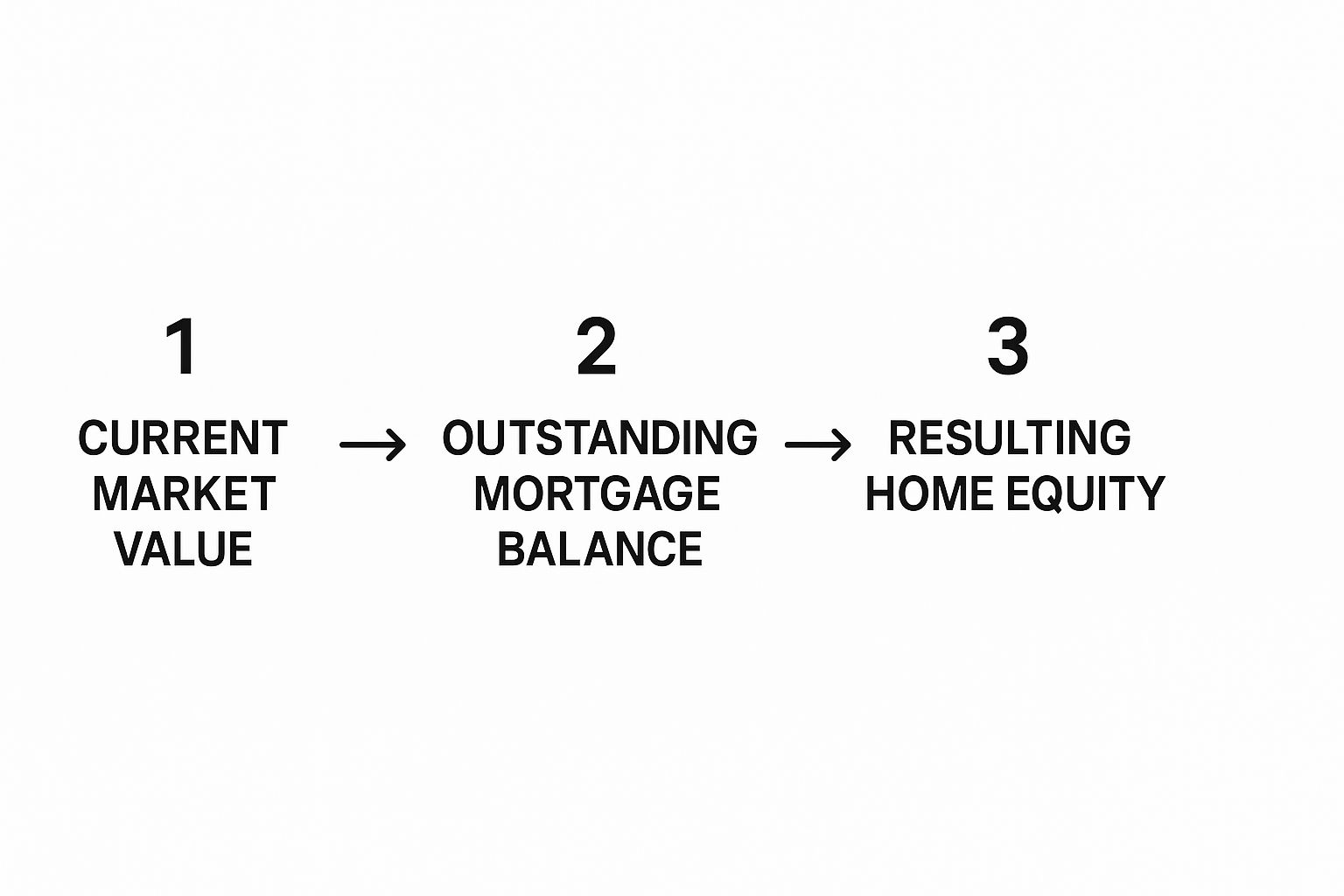

Below is a quick breakdown of how these pieces fit together.

Equity At A Glance

| Component | What It Means | Example |

|---|---|---|

| Current Market Value | The price your home would likely sell for in today’s Dallas market. | Your Dallas home is valued at $450,000. |

| Mortgage Balance | The total amount you still owe to your lender. | You have $250,000 left to pay on your mortgage. |

| Your Equity | The portion you own, calculated by subtracting the balance from the value. | You have $200,000 in home equity. |

This table shows the simple but powerful math behind your financial stake in your home. It’s a key metric of your financial health.

Nationally, real estate represents a massive cornerstone of personal finance. For instance, total U.S. residential real estate equity has soared into the trillions, proving just how powerful a tool it is for local owners here in Dallas.

For a Dallas owner, understanding your equity is the first step toward making smart financial moves. It influences everything, from your ability to sell for a profit to your options for future investments. It’s a key indicator of your financial health, shaped by both your mortgage payments and the wider economic climate, which you can dive into with our guide on Dallas living expenses and affordability.

Your equity serves as a financial cushion and a potential source of capital, providing flexibility whether you plan to renovate, invest, or simply build long-term wealth in North Texas.

Alright, let’s ditch the textbook definition and talk about what home equity really means for you as a Dallas homeowner. Think of it as your financial foothold in the property market—the part of your home you truly own, free and clear.

It’s a pretty simple concept, but incredibly powerful.

Calculating Your Equity in a Dallas Property

At its core, calculating your equity is just simple subtraction. You take what your home is worth today and subtract what you still owe on your mortgage. The number left over is your equity. It’s your skin in the game.

Let’s walk through a real-world Dallas scenario. Say you bought a place in a hot neighborhood like the Bishop Arts District or Uptown a few years back. The market has been kind, and now your home’s estimated current market value is $550,000. You pull up your latest mortgage statement and see you have an outstanding balance of $350,000.

Here’s the math: $550,000 (What It’s Worth) – $350,000 (What You Owe) = $200,000 (Your Equity).

That $200,000 is your slice of the pie. It’s the wealth you’ve built just by paying your mortgage and letting the Dallas market do its thing.

This graphic breaks it down visually.

As you can see, it all starts with figuring out your property’s current value before subtracting your loan balance.

Getting an Accurate Valuation

Now, for this calculation to be useful, you need a solid, realistic number for your home’s market value. A wild guess or a Zillow Zestimate isn’t going to cut it if you’re planning a major financial move.

Here are the two best ways to nail down your Dallas property’s true worth:

- Comparative Market Analysis (CMA): A local Dallas-area REALTOR® can pull this for you. They’ll analyze what similar homes right in your neighborhood have recently sold for, giving you a very reliable estimate of your home’s current market value.

- Formal Appraisal: This is the gold standard. When you’re refinancing or applying for a loan, a state-licensed appraiser will perform a deep-dive inspection and analysis to give you an official valuation.

Understanding Loan-to-Value Ratio

Once you know your equity, you can also figure out another key number lenders love: your Loan-to-Value (LTV) ratio. It’s a quick way for Dallas lenders to gauge their risk. You just divide your mortgage balance by your property’s market value.

Let’s use our example again: $350,000 / $550,000 = 63.6% LTV.

A lower LTV is always better. It tells lenders that you have significant equity built up, which makes you a much safer, more attractive borrower for any future financing needs.

How To Build Equity In The Dallas Market

So, what does “equity” actually mean for you as a homeowner? Think of it as your personal stake in your property—the slice of the home that is truly yours, not the bank’s. Growing your equity in a dynamic market like Dallas comes down to two main forces: one you control directly, and another that works for you behind the scenes.

The most straightforward way to build your ownership is by making your monthly mortgage payments. Every single payment has a portion dedicated to the principal balance of your loan. This chips away at what you owe, directly increasing your equity month after month. It’s a steady, reliable way to boost your financial position in your home.

The second method, and often the most exciting, is property appreciation. This is where your home’s value goes up over time, thanks to the powerful forces of the local market. In a high-demand area like North Texas, this can become a serious wealth-building engine.

The Power Of Appreciation In Dallas

The Dallas-Fort Worth metroplex is in a constant state of growth. Major corporate relocations to suburbs like Frisco, shiny new developments, and infrastructure upgrades all help push property values higher across the region. As more people want to live in North Texas, the value of your home—and your equity—naturally rises with the tide.

Picture this: A person buys a home in Plano. For the next few years, they diligently make their mortgage payments. At the same time, the neighborhood gets a new park and a popular retail center, making it an even hotter place to live. Local property values begin to climb.

Their equity has grown from two sources at once: their own payments reducing the loan and the market increasing the property’s value. This dual-action growth is how many Dallas property owners see their net worth increase significantly over time.

Of course, you can also take matters into your own hands with strategic home improvements. Upgrades that boost your property’s value can accelerate your equity growth even further. For instance, understanding if solar is a worthwhile investment is a great example of an improvement that can add significant, tangible value to your home.

Using Your Home Equity as a Financial Tool

Once you’ve built up a good amount of equity, it stops being just a number on a statement and becomes a powerful financial resource. For Dallas property owners, this isn’t just a safety net; it’s real capital you can put to work. The best part? You can tap into this wealth without having to sell your home.

Generally, there are two main ways to do this. The first is a home equity loan, which gives you a lump sum of cash with a fixed interest rate. This makes for very predictable monthly payments. The second option is a Home Equity Line of Credit (HELOC), which works more like a credit card, letting you draw money as you need it, up to a pre-approved limit.

Strategic Uses for Your Dallas Home Equity

How you decide to use this capital can have a huge impact on your financial future. It’s a move that calls for smart planning and a solid understanding of both the opportunities and the responsibilities that come with borrowing against your home.

Here are a few strategic ways Dallas homeowners are putting their equity to good use:

- Fund a Major Renovation: Think about using a HELOC to finally do that complete kitchen and master bath overhaul on your Lakewood property. Not only does this dramatically improve your daily life, but it can also increase your home’s market value—sometimes enough to essentially pay for the renovation itself when you sell.

- Invest in More Real Estate: A homeowner could pull cash out of their primary residence to use as a down payment on an investment property in a booming area like Fort Worth. This is a classic move for building a real estate portfolio, a tactic we break down in our Dallas real estate investment guide.

- Consolidate High-Interest Debt: Taking out a home equity loan to wipe out high-interest credit card balances or personal loans can be a game-changer. It can lower your total monthly debt payments and save you a small fortune in interest charges over time.

Leveraging equity is a cornerstone of real estate investment. It’s the engine that fuels portfolio growth, allowing seasoned investors to expand their holdings by accessing the value in properties they already own.

This strategy has a massive effect on the local and national economy. To give you some perspective, US real estate investment volumes were recently a significant portion of the global total. Much of that activity is powered by investors in key markets like Dallas leveraging their existing equity.

For investors who want to defer taxes when they sell one property and reinvest in another, understanding strategies like a What Is a 1031 Exchange is also incredibly valuable.

Navigating Dallas Real Rstate Cycles with Equity

Your home equity isn’t just a number on a spreadsheet; it’s a living part of the Dallas real estate ecosystem. The amount of equity you’ve built can either give you a powerful advantage or seriously tie your hands, depending on which way the market winds are blowing.

Think of it this way: when a lot of Dallas homeowners are sitting on a healthy pile of equity, they feel more financially secure. That confidence often translates into action—more people feel comfortable selling their homes to upgrade or downsize. This, in turn, adds much-needed inventory to the market and helps keep prices stable for everyone.

On the flip side, a market downturn can chip away at property values, pushing homeowners into low or even negative equity. This is the dreaded “underwater” scenario, where you owe more than your home is worth. When that happens, selling without taking a major financial hit becomes nearly impossible, causing the market to grind to a halt as listings dry up.

Why Tracking Your Equity Matters

Knowing where you stand with your equity helps you make smarter, more strategic moves, no matter what the market is doing. It’s the key to knowing the right time to sell, refinance for a better rate, or pull out cash for a new investment. Staying informed is essential, especially when you consider the latest Dallas housing market trends and insights and see how your property stacks up against the bigger picture.

Historically, home equity has always been a fundamental pillar of wealth creation and economic stability for homeowners.

According to the Federal Reserve, homeowners nationwide were recently holding over $19 trillion in home equity. That staggering figure represents a massive slice of total household wealth and is the financial engine that powers everything from kitchen remodels to comfortable retirements.

This huge equity stake is a powerful economic force, but it’s not invincible. As seen during the 2007-2009 financial crisis, sharp drops in property values can wipe out trillions in equity, creating widespread financial distress for homeowners and sending shockwaves through the economy.

Common Questions About Dallas Real Estate Equity

Once Dallas homeowners start wrapping their heads around real estate equity, the same practical questions tend to pop up. Let’s tackle some of the most common things people ask, so you can see how these ideas apply directly to your own home.

How Quickly Can I Build Equity in Dallas?

There are really two engines that build equity: you paying down your mortgage, and the market pushing your home’s value up. Paying your mortgage is the slow-and-steady route. But a hot market like Dallas can feel like hitting the nitrous button on appreciation.

We’ve seen some incredible market runs in the DFW metroplex over the last few years, and that’s added a ton of equity to homeowners’ net worth, sometimes surprisingly fast. But you can’t bank on that. The market gives, and the market can take away.

The one thing you have total control over is making extra principal payments. Even tossing a little extra cash at your loan principal now and then can trim years off your mortgage and seriously accelerate how quickly you build your ownership stake.

Key Takeaway: In a strong market, Dallas property owners get a double-win from their payments and market appreciation. But relying only on the market is a gamble. Proactive payments are your surest bet for faster equity growth.

Is Using a HELOC for Renovations a Good Idea?

Tapping into your home’s equity with a Home Equity Line of Credit (HELOC) to fund renovations can be a brilliant financial move. But there’s a big “if”—it all comes down to picking the right project. The goal is simple: the renovation should add more value to your home than the project and the loan cost you.

Here in Dallas, we see certain upgrades consistently delivering a great return. Buyers love:

- Kitchen Remodels: A sharp, modern kitchen is always a huge draw.

- Bathroom Upgrades: Adding or updating bathrooms is a proven value-add.

- Creating Outdoor Living Spaces: In our Texas climate, a great patio, deck, or outdoor kitchen is a major lifestyle feature that buyers will pay for.

Before you pull the trigger, you have to do the math. Compare the all-in cost of the HELOC against the potential bump in your home’s value. Just as important, make sure the renovation fits the style and standard of your specific Dallas neighborhood to get the biggest bang for your buck on a future appraisal.

What if My Property Value Drops Below My Mortgage?

This is a tough spot. When your home’s market value sinks below what you still owe, you have “negative equity,” or what everyone calls being “underwater.” It’s a challenging position because you can’t sell without bringing your own money to closing, and refinancing is pretty much off the table.

While it hasn’t been a common problem in Dallas’s recent high-growth environment, it’s a real risk in any real estate cycle. If you ever find yourself in this situation, the absolute best thing to do is keep making your mortgage payments on time. Every single payment chips away at your loan principal, helping you slowly but surely close that gap until the market eventually turns around and you’re back in the black.

Are you ready to understand your own equity position or explore real estate opportunities in Dallas? The team at Dustin Pitts REALTOR Dallas Real Estate Agent has the local expertise to guide you. From accurate property valuations to strategic investment advice, we provide the insights you need to make confident decisions in the Dallas market. Connect with us today to get started!