So, you’ve been pre-approved for a mortgage and found your dream home in Dallas. What’s next? You’re heading into one of the most crucial, yet often misunderstood, stages of the home-buying journey: mortgage underwriting.

Think of underwriting as the lender’s final due diligence. It’s where they take a magnifying glass to your finances to make absolutely sure you can handle the loan. An underwriter, a real person, is about to become very familiar with your financial life to give that final thumbs-up.

Your Guide to Dallas Mortgage Underwriting

The mortgage underwriter is essentially the gatekeeper for your home loan. Their job is to meticulously verify every single piece of information you provided on your application. They’re looking for consistency, accuracy, and, most importantly, proof that lending you a significant amount of money is a reasonable risk for the bank.

This isn’t just about running your numbers through a computer again; this is a hands-on review that goes far deeper than the initial pre-approval. Whether you’re buying a modern condo in Uptown or a historic home in Bishop Arts, a smooth underwriting process is the key to closing on time in the competitive Dallas market.

Why Underwriting Is a Critical Step

At its heart, underwriting is all about risk management for the lender. If they’re going to lend you hundreds of thousands of dollars, they need solid proof that you’ll pay it back, month after month, for years to come.

To get that proof, the underwriter digs into four main areas of your financial profile, often called the “Four C’s.”

- Credit: They’ll look beyond just your credit score. They want to see a history of on-time payments and responsible borrowing.

- Capacity: This is your ability to repay the loan. They’ll scrutinize your income streams and compare them against your total monthly debts to calculate your debt-to-income (DTI) ratio.

- Capital: Do you have the cash for the down payment and closing costs? They’ll verify your bank statements to confirm you have the funds ready to go, plus some reserves left over.

- Collateral: This is the house itself. An independent appraisal is ordered to confirm the Dallas property is actually worth the price you’re paying. The home is the lender’s security, after all.

It’s easy to see underwriting as a stressful final exam. A better way to look at it is a confirmation step—a process designed to ensure that this massive financial commitment is a sound decision for both you and the lender.

To give you a clearer picture, here’s a quick breakdown of how underwriters view these key criteria.

The Four C’s of Mortgage Underwriting in Dallas

| Criteria | What It Means for Your Dallas Home Purchase |

|---|---|

| Credit | The underwriter examines your credit report for a history of reliability. Late payments or high balances can be red flags. |

| Capacity | Your income and employment are verified to confirm you can handle the monthly mortgage payment on top of your existing debts. |

| Capital | They need to see you have the cash for your down payment and closing costs without draining every last penny from your accounts. |

| Collateral | The appraisal must show the home’s value supports the loan amount. The lender won’t loan more than the property is worth. |

Ultimately, the underwriter is piecing together your complete financial story. Your job is to provide them with all the chapters so they can see the full, positive picture.

Meet the Team Underwriting Your Dallas Home Loan

When you apply for a mortgage, your application doesn’t just disappear into a black box. It’s actually passed between a small team of specialists, each with a specific job to do to get your Dallas home loan from application to closing day.

Think of it like a relay race where your loan application is the baton. Each person plays a critical part before handing it off to the next. Understanding who these people are and what they do can take a lot of the mystery out of the process.

The Loan Officer: Your Primary Guide

First up is your loan officer. This is the person you’ll interact with the most, acting as your main point of contact and your guide through the entire journey. They’re the public face of the lender and, ideally, your biggest advocate.

A great Dallas-based loan officer knows the local market inside and out, which helps them position your application for the best chance of success right from the start. They’ll help you with the initial paperwork, lock in your interest rate, and be there to answer your questions. When the underwriter asks for more info, that request usually comes through your loan officer, who can help you put together the right response.

The Processor: The Document Organizer

After you’ve submitted your application, the baton gets passed to the loan processor. Their job is all about organization and verification. They are the ones who meticulously collect every single document and make sure your file is buttoned up and complete before it ever gets to an underwriter.

From tracking down your employment verification to ordering the title report for that property in Dallas County, the processor does the legwork. They basically build a complete, easy-to-read financial story for the underwriter, which makes the next step much smoother.

The underwriting process is a collaborative effort, not a black box. Knowing the distinct roles of the loan officer, processor, and underwriter transforms it into a clear journey with a defined division of labor, empowering you to navigate it more effectively.

The Underwriter: The Final Decision Maker

Finally, your fully assembled loan file lands on the desk of the mortgage underwriter. This person is the ultimate decision-maker. They don’t work on commission; their sole responsibility is to protect the lender from taking on too much risk.

The underwriter takes a deep, analytical dive into the file your processor built. They scrutinize everything—your credit history, your income and ability to repay (capacity), your savings (capital), and the property itself (collateral)—against a strict set of lending guidelines. It’s their impartial, expert judgment that leads to the final “yes” or “no,” making their role the most critical part of the what is mortgage underwriting process.

How Underwriters Evaluate Your Finances

When an underwriter gets your loan file for a Dallas property, they’re not just glancing at a few numbers. Their job is to build a complete financial picture of you as a borrower, and they do this using a time-tested framework known as the “Four Cs”: Credit, Capacity, Capital, and Collateral.

Each “C” gives the underwriter a different piece of the puzzle. Together, they help the lender get comfortable with the risk of funding your loan. Think of it as a comprehensive financial health check-up, where the underwriter is the specialist making sure you’re in a solid position to handle a Dallas-sized mortgage. Let’s break down exactly what they’re looking at.

Your Credit And Capacity To Repay

First up is your Credit. This goes way deeper than just your three-digit FICO score. Underwriters meticulously review your entire credit report, looking for a long, consistent history of on-time payments for things like credit cards, car loans, or student debt. They want to see a track record of reliability.

Next, they dig into your Capacity, which is just a formal way of asking, “Can you actually afford this new mortgage payment?” This is where your debt-to-income (DTI) ratio takes center stage. The underwriter will verify every source of income you have—whether it’s a salary from a downtown Dallas firm or freelance work—and weigh it against all your monthly debt payments. To get a better handle on this crucial metric, you can explore our guide that explains in detail https://dustinpitts.com/uncategorized/what-is-debt-to-income-ratio/.

From a risk perspective, the mortgage underwriting process still heavily weighs borrower credit quality and loan characteristics. Data shows that borrower risk increased slightly from 1.40% to 1.43% in the first quarter of the year. Purchase loans, which make up about 82% of new originations, often feature strong underwriting quality with average FICO scores above 700.

Analyzing Your Capital And Collateral

Once they’ve confirmed you can handle the payments, the underwriter looks at your Capital. These are your liquid assets—the money you have ready for the down payment and closing costs. This obviously includes your checking and savings accounts, but it can also include things like vested stock options or funds from the sale of another property. The underwriter just needs to see that you have the required cash to close without completely draining your savings.

Finally, there’s the Collateral—the house itself. The lender isn’t just taking your word for what the property is worth. They order a professional appraisal to get an independent valuation, ensuring the home’s value is high enough to secure the loan amount. An appraisal on a historic Tudor in the M-Streets will be very different from one on a new build in Frisco, as it depends on recent comparable sales in that specific neighborhood. A key concept here is understanding What is Fair Market Value, as it’s the foundation for the entire appraisal process.

Your Step-by-Step DFW Underwriting Timeline

Thinking about mortgage underwriting can be daunting, but it helps to see it as a clear, step-by-step timeline rather than one big, scary event. Especially here in the competitive Dallas-Fort Worth market, understanding the journey from application to closing day is key. While some parts are now automated, a real person is still making the final call on your loan.

The clock officially starts ticking once your loan processor has gathered all your documents and assembled your file. That complete package gets sent over to the underwriting department, and the real review process begins.

The Initial Review and Getting “Conditional Approval”

The first hurdle for your application is usually an Automated Underwriting System (AUS). Think of this as a powerful software program that does a quick once-over on your file, checking it against standard guidelines from giants like Fannie Mae or Freddie Mac. An AUS approval is a fantastic first step, but it’s not the final say. A human underwriter always has to sign off.

Next, a human underwriter takes the wheel. They will comb through every detail of your credit history, your income (capacity), your savings (capital), and the details of the home you want to buy. If everything checks out on their end, they’ll issue a conditional approval.

This is a major milestone! It means the lender is ready to approve your loan as long as you provide a few final items. These “conditions” are typically straightforward requests, like sending over your most recent pay stub or writing a quick letter explaining a large deposit in your bank account.

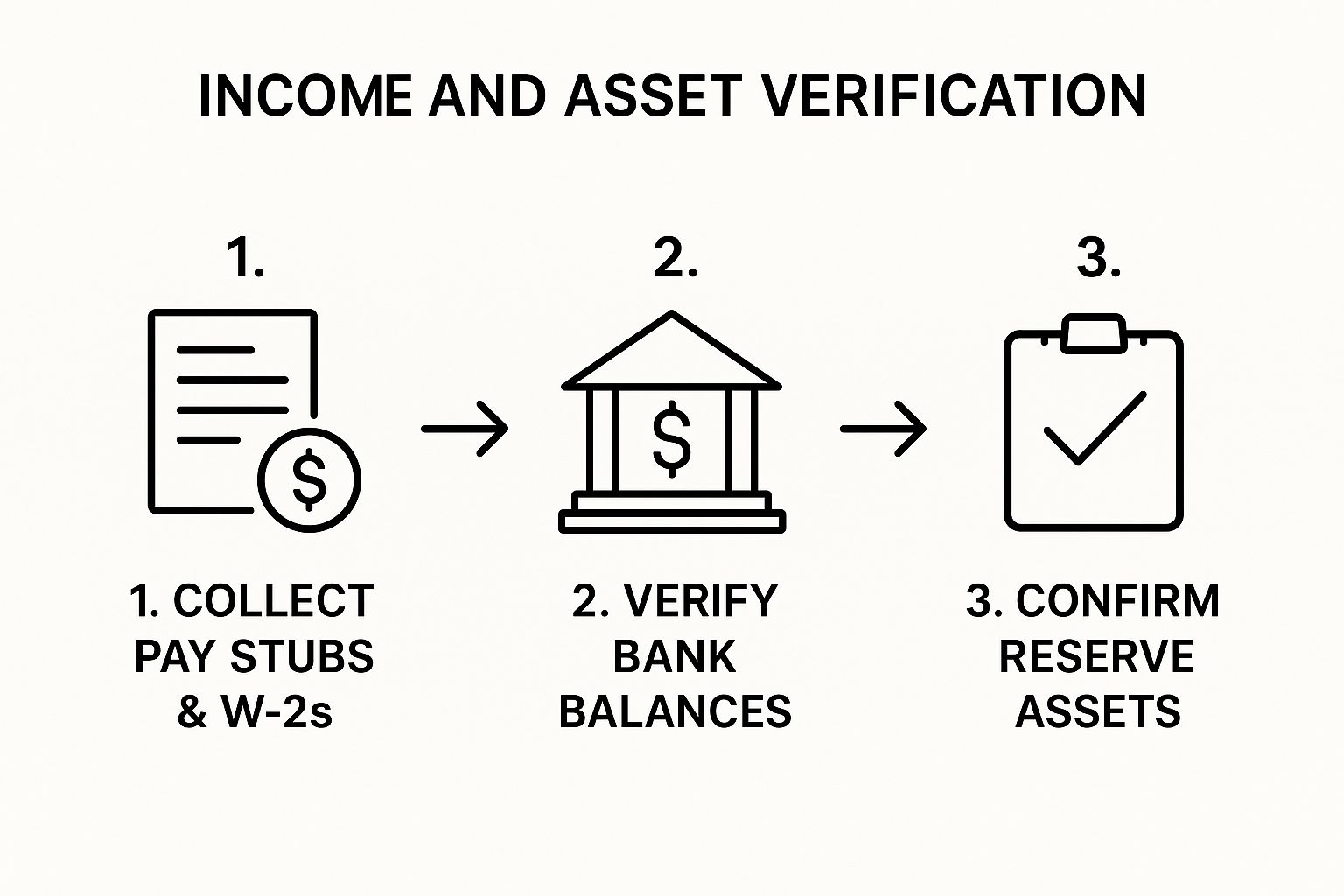

This image gives you a simple look at how underwriters confirm your income and assets.

As you can see, it’s all about a methodical process of collecting, confirming, and cross-referencing your financial documents to build a complete, trustworthy picture.

Finalizing the Property Details and Getting the Green Light

While you’re busy tracking down your last few documents, the underwriter shifts focus to the property itself—the collateral for the loan. They’ll order two crucial reports: a property appraisal and a title search. The appraisal makes sure the home is actually worth what you’re paying, and the title search confirms there aren’t any hidden ownership claims or liens on the property.

You can get a much deeper understanding of this vital step by reading our guide on the real estate appraisal process.

Once you’ve cleared all your conditions and the underwriter has approved both the appraisal and title reports, they give the final sign-off. This is when you’ll get the best news of the whole process: you are “clear to close.”

That’s the ultimate green light. It means you’ve satisfied every single underwriting requirement, and the lender is officially ready to fund your loan on closing day.

Dodging Common Underwriting Hurdles in Texas

Even the most buttoned-up mortgage application can hit a bump in the road during underwriting. In a hot market like Dallas, these kinds of snags can lead to frustrating delays. The good news is that if you know what underwriters are looking for, you can steer clear of most potential problems and keep your closing on schedule.

Honestly, a lot of these roadblocks are completely avoidable. They usually pop up from simple mistakes or financial decisions made after you’ve applied but before you’ve closed. Think of it this way: from the moment you apply for that loan until you’re holding the keys to your new Dallas home, your financial life needs to be frozen in time.

Mysterious Deposits and Last-Minute Purchases

One of the quickest ways to get an underwriter’s attention—and not in a good way—is to have a large, unexplained cash deposit show up in your bank account. If a chunk of money suddenly appears, they’re going to want to see a paper trail. They need to be sure it’s not a secret loan that could mess up your debt-to-income ratio.

Going on a spending spree is another huge mistake. Buying a new car or financing a house full of furniture on credit while you’re in underwriting can torpedo your approval. It completely changes the financial picture the lender originally approved, and it could easily push your DTI over the edge.

- How to Handle Gift Money: If you’re receiving help with the down payment, you’ll need a formal gift letter. It just needs to state that the money is a true gift and doesn’t have to be paid back.

- How to Handle Big Purchases: This one’s easy: just wait. Hold off on any major buys or new credit applications until after you’ve officially closed on your home.

Job Hopping and Appraisal Gaps

Switching jobs right in the middle of the mortgage process can slam the brakes on everything. Underwriters crave stability. Even if your new job comes with a nice raise, it introduces a big question mark. They’ll have to start the income and employment verification process all over again, which takes time and adds a layer of complication.

Another hurdle we see a lot in competitive Dallas neighborhoods like Lakewood or Preston Hollow is the appraisal gap. This is what happens when the home’s official appraisal comes in lower than the price you agreed to pay. The bank will only lend you what the appraiser says the home is worth, meaning you’re on the hook for the difference.

Underwriting isn’t static; it’s constantly changing with the economy. Recent industry data shows the mortgage quality control defect rate just ticked up to 1.31%. That number tells us that underwriters are running into more challenges when assessing borrower risk. It’s a great reminder of why a clean, well-documented application is so critical—it helps you avoid becoming another statistic. You can read more about these mortgage quality trends on ACESQuality.com.

By knowing what trips people up, you can be proactive. A little foresight goes a long way in making sure your journey through the what is mortgage underwriting process is as smooth as possible, getting you to the closing table without all the extra stress.

Proven Tips for a Smooth Underwriting Experience

Getting through mortgage underwriting in Dallas doesn’t have to be a nail-biting experience. It really comes down to being prepared and staying proactive. If you can give the underwriter a clean, straightforward financial picture from day one, you’ll dramatically boost your chances of a quick and painless closing.

Think of organization as your secret weapon. Before your loan application even lands on an underwriter’s desk, get all your financial documents in order. We’re talking pay stubs, bank statements, tax returns—the whole nine yards. Having everything ready to go avoids those frantic last-minute searches for paperwork and shows the lender you’re a reliable borrower, which starts the whole process off on the right foot.

Prepare Early and Communicate Clearly

Honestly, the best thing you can do is get pre-approved well before you even start looking at homes in Dallas. A solid pre-approval process acts like a diagnostic check-up, often catching potential red flags—like errors on your credit report or a DTI ratio that’s a little too high—while you still have plenty of time to fix them. To get a better idea of what lenders look for, check out our guide on mortgage pre-approval requirements.

Once your loan is in motion, it’s time to enter a “financial quiet zone.” Seriously. Don’t make any large purchases, don’t open new lines of credit, and try not to change jobs. Any sudden move can force the underwriter to start their review all over again, which can lead to some serious delays.

Key Takeaway: The underwriting stage is no time for financial surprises. Consistency and honesty are everything. Your job is to make the underwriter’s job easy by presenting a financial story that’s clear and simple to verify.

Finally, stay in close contact with your loan officer. If the underwriter asks for another document or has a question, get them an answer as quickly and completely as you can. A critical piece of the puzzle is handling all the property-specific requirements, like understanding the importance of securing homeowners insurance, before it becomes a last-minute scramble. Following these simple tips will help you walk into your Dallas mortgage application with confidence.

Frequently Asked Questions

When you’re in the thick of buying a home in Dallas, the underwriting process can feel like a black box. You’ve submitted a mountain of paperwork, and now you’re waiting. It’s only natural to have questions.

Let’s clear up some of the most common things we hear from DFW homebuyers. Getting these answers can help you feel more in control and less stressed as you head toward the closing table.

How Long Does Mortgage Underwriting Take in Dallas?

There’s no single magic number, but in the fast-paced Dallas market, you can generally expect the active underwriting phase to take anywhere from a few days to a couple of weeks.

The full timeline, from the day you apply to the day you get the “clear to close,” usually falls somewhere in the 30 to 45-day range. The biggest factor you can control? Your responsiveness. Getting documents back to your lender quickly is the best way to keep things moving.

What Is a Conditional Approval from an Underwriter?

Getting a conditional approval is a great sign! It means the underwriter has given your loan a preliminary thumbs-up, but they need a few more items to finalize everything. Think of it as a “yes, if…”

These final requests, or “conditions,” are typically straightforward. They might include:

- Your most recent pay stub to verify you’re still employed.

- A short letter from you explaining where a recent large deposit came from.

- Proof that you’ve secured homeowners insurance for your new Dallas property.

It’s the underwriter’s way of tying up loose ends. Once you satisfy these conditions, you’re on the home stretch to full approval.

Can I Switch Jobs While My Loan Is in Underwriting?

In a word: don’t. We strongly advise against changing jobs while your loan is in underwriting.

Even if you’re moving to a better-paying position right here in Dallas, a change in employment forces the underwriter to hit the brakes and start their verification process all over again. This can cause major delays and, in a worst-case scenario, could even put your entire loan at risk. If a job change is completely unavoidable, tell your loan officer the second you know about it so they can help you navigate the fallout.

Ready to navigate the Dallas real estate market with an expert guide? The team at Dustin Pitts REALTOR Dallas Real Estate Agent has the local knowledge and experience to make your home buying process a success. Start your journey with us today.