Think of title insurance as your financial bodyguard for what is likely the biggest purchase of your life. It’s a specialized, one-time insurance policy that protects you from financial ruin and legal headaches if some long-buried problem with the property’s ownership history suddenly comes to light after you’ve bought it. For anyone navigating the fast-paced Dallas real estate market, getting a handle on this is non-negotiable.

Your Guide to Title Insurance in Dallas

When you buy a property in Dallas, you’re buying more than just the building and the land it sits on. You’re actually purchasing the legal rights to own and use that property—a concept known as the “title.” Simply put, the title is the official, documented proof of your ownership.

But a property’s past can be messy. Imagine finding out that a long-lost heir has a claim to your home, a Dallas contractor placed a lien on it years ago for an unpaid bill, or that a signature on a past deed was forged. These nasty surprises are called “title defects” or “clouds on the title.”

What Does Title Insurance Actually Do?

This is precisely where title insurance steps in. Before you close the deal, a title company digs deep into public records, searching for any red flags tied to the property. It’s a thorough investigation, but even the best researchers can’t uncover everything.

Title insurance is unique. It’s the only type of insurance that protects you from things that happened in the past, not what might happen in the future. It’s a defensive play against historical mistakes that could jeopardize your ownership today.

If an undiscovered issue—like a valid claim from a previous owner—surfaces after you’ve closed, your title insurance policy is there to cover your legal defense costs and any financial losses that result. It’s your safety net.

To get started, here’s a quick look at the two main types of title insurance you’ll encounter in a Dallas real estate transaction.

Title Insurance at a Glance

This table breaks down the core differences between an owner’s policy (which protects you) and a lender’s policy (which protects your bank). We’ll dive deeper into what these mean for you as a Dallas property buyer later on.

| Feature | Owner’s Title Insurance | Lender’s Title Insurance |

|---|---|---|

| Who It Protects | The property owner (you) | The mortgage lender |

| Coverage | Your equity and right of ownership | The lender’s financial investment |

| Payment | One-time premium, often paid by the seller in Dallas | One-time premium, paid by the buyer |

| Duration | Lasts as long as you or your heirs own the property | Lasts until the mortgage is paid off |

As you can see, both policies serve a critical purpose, but they protect different parties involved in the transaction. Understanding this distinction is the first step to ensuring you’re fully covered.

Why Title Insurance Is Essential for Dallas Properties

Think of a property’s title as its official life story. This legal document is your proof of ownership, but just like any long story, it can have hidden chapters and unexpected plot twists from the past. Lurking in a property’s history could be anything from unresolved liens and forged documents to an undiscovered heir with a legitimate claim to the home you’re about to buy.

The title search is essentially a background check on your potential Dallas property. A title company digs deep into historical records to confirm the seller has the undisputed right to transfer ownership to you. They’re on the hunt for anything that could “cloud” the title and jeopardize your claim to the property down the road.

But here’s the thing: even the most thorough search can’t always find every single skeleton in the closet. Some issues are simply buried too deep in the past or were never documented correctly in the first place.

Shielding Your Investment from Hidden Risks

This is exactly where the insurance part comes in. Title insurance is a unique type of policy that protects you and your lender from financial loss caused by defects in a property’s title. The global market for this protection was recently valued at around $67.42 billion and is projected to nearly double, which tells you just how critical it has become in real estate transactions everywhere, including Dallas.

In a dynamic city like Dallas, specific title risks are more common than you might think. A contractor who worked on a house years ago could have an old, unpaid mechanic’s lien on the books. Or there could be a simple clerical error filed at the Dallas County Records Building that incorrectly describes the property’s boundaries.

A huge part of protecting your investment is understanding what due diligence is. Title insurance is a cornerstone of that process. It’s about taking smart, reasonable steps to protect yourself from future problems.

Your Final Line of Defense

Even when a title search comes back looking “clean,” you aren’t completely out of the woods. Some of the most dangerous hazards are the ones a standard search can’t uncover.

- Forgeries and Fraud: What if a signature on a deed from 20 years ago was forged? That could make a past sale totally illegitimate.

- Undisclosed Heirs: Someone who inherited the property decades ago—but was never properly notified—could suddenly show up with a valid claim.

- Errors in Public Records: A simple typo or filing mistake can create a massive ownership headache years later.

Without an owner’s title insurance policy, you’d be on your own. You’d have to pay out-of-pocket for your legal defense, and in a worst-case scenario, you could lose your entire investment if a claim against your title proves valid. The policy steps in to cover these legal costs and protect your right to the property, making it an absolutely essential safeguard for any Dallas property buyer.

Breaking Down the Two Types of Title Policies

When people talk about “title insurance,” they’re often lumping two very different things together. In any Dallas real estate deal, you’re actually dealing with two separate policies, and each one protects a different party at the closing table. Knowing the difference isn’t just trivia—it’s crucial for protecting your own skin.

First up is the lender’s title insurance policy. If you’re taking out a mortgage in Dallas, this one isn’t optional. Your bank will absolutely require it, and its job is simple: to protect their investment in your property.

This policy ensures the bank’s loan is a legitimate, enforceable lien. It protects them until you pay off the mortgage, but that’s where its protection ends. It does absolutely nothing for you or the equity you’re building.

The Owner’s Policy: Your Personal Safety Net

The second policy is the one that really matters for you as a property owner: the owner’s title insurance policy. Think of this as your personal shield. This policy defends your claim to the property against any old, hidden title problems that might crawl out of the woodwork. It’s what stands between you and a financial or legal nightmare over who truly owns your home.

This protection is so essential that the market for it is growing steadily. The owner’s title insurance market was valued at $1.5 billion in 2023 and is on track to hit $2.1 billion by 2032 as property ownership laws become even more complex. You can dig into the growth of the title insurance market from this report for more details.

The difference couldn’t be clearer: A lender’s policy protects the loan, while an owner’s policy protects your home, your rights, and your equity. One is for them, the other is for you.

A Real-World Dallas Example

Let’s say you just bought a gorgeous, updated house in the M Streets. You’ve been living there for five years, loving the neighborhood, when a certified letter arrives. It turns out a long-lost heir of a previous owner from decades ago has come forward with a legitimate legal claim to a piece of your property.

If you don’t have an owner’s policy, you’re on your own. You’d have to hire lawyers, pay court fees, and potentially spend tens of thousands of dollars just to defend your title. And if you lose? You could be out a chunk of your home’s value or, in a worst-case scenario, be forced to sell.

Now, imagine the same situation with an owner’s policy. Your response is completely different. You make one phone call to your title insurance company. From that point on, they take over. They handle the legal fight, they cover the costs, and if the heir’s claim holds up, they pay you for any financial loss. That one-time payment you made at closing just bought you priceless peace of mind for as long as you and your heirs own the home.

How Much Does Title Insurance Cost in Texas? Let’s Break It Down

When you’re figuring out your budget for a new home in Dallas, the cost of title insurance is one of the more predictable expenses you’ll encounter. This is a huge plus, especially when other costs can feel a bit uncertain.

The reason for this predictability is simple: title insurance rates aren’t set by individual companies looking to compete on price. Instead, they are regulated and standardized by the Texas Department of Insurance (TDI). That means the premium you pay is the same no matter which title company in Dallas you work with.

This system takes the guesswork out of the equation. You don’t have to spend your valuable time shopping around for a better rate. Your focus can shift to what really matters—choosing a title company known for excellent service, a solid reputation, and a smooth closing process. The cost is a one-time premium paid at closing, not an ongoing bill you’ll see every month or year.

The Math Behind the Premium

So, how is the actual number calculated? The TDI uses a tiered rate schedule based directly on the home’s sale price.

For example, on a $400,000 home in Dallas, the premium is calculated using a set rate for every thousand dollars of the property’s value. It’s a straightforward formula that ensures everyone pays a fair, consistent price for the same level of protection.

This one-time fee is just one piece of your overall closing expenses. To see how it fits into the bigger picture, you can learn more by checking out our guide on how to calculate closing costs.

Who Typically Pays for Title Insurance in a Dallas Deal?

In most Dallas-area real estate transactions, there’s a pretty standard way the costs for the two different policies are handled. While it’s always negotiable, here’s what you can generally expect:

- The Seller almost always pays for the owner’s title insurance policy.

- The Buyer is responsible for the lender’s title insurance policy, since it’s required to get the mortgage.

This split is one of the great traditions of Texas real estate. It makes getting full protection for your new property incredibly straightforward and affordable right from the start.

Think of the seller covering your owner’s policy as their final act of good faith. They are essentially guaranteeing that the property they’re handing over has a clean, unencumbered history. It’s a standard practice in Dallas that provides immense peace of mind to the new owner.

You can see just how critical title insurance is in Texas. In the first quarter of the year, Texas led the entire nation in title insurance premium volume, generating a staggering $580.9 million. This figure really drives home how vital this protection is, especially in a fast-moving market like Dallas. You can dig deeper into these Q1 2025 market share statistics to learn more.

Navigating the Title and Closing Process in Dallas

It’s one thing to talk about title insurance in theory, but it’s another to see how it all comes together when you’re buying a home here in Dallas. The good news is that the process is very structured, kicking off the second your offer on a house gets accepted.

The first step is “opening escrow.” You or your agent will choose a title company, and they become the neutral third party in the deal. They hold onto all the important stuff—like the earnest money and eventually the deed itself—making sure everything is handled securely until the sale is officially final.

The Deep Dive into Property History

With escrow open, the title company’s examiners roll up their sleeves and start the title search. Think of them as property detectives. They’ll dig deep into the property’s history, scouring public records, many of which are filed right at the Dallas County Clerk’s office.

Their mission is to find anything that could threaten your claim to the property. They’re specifically looking for red flags like:

- Unpaid property taxes that could result in a lien.

- Old mortgages that were never properly released.

- Legal judgments against previous owners.

- Easements or boundary line issues that could limit how you use your land.

This whole investigation is designed to find any “clouds” on the title so they can be dealt with before you take ownership. This piece of the puzzle makes a lot more sense when you’re also understanding the broader home loan approval and settlement process and how all the parts fit together.

Receiving Your Title Commitment

Once the search is done, the title company sends you a document called the Title Commitment. This is a big deal. It’s essentially a sneak peek of your final insurance policy and a promise from the title company to issue that policy once a few conditions are met.

The Title Commitment is your chance to see what they found. It will list any known problems that need to be fixed before closing, and it will also spell out any specific exceptions that your final policy won’t cover. Sit down with your real estate agent and go through this document with a fine-tooth comb—it’s that important.

This report gives you a clear picture of the title’s health and lays out the roadmap for getting to the closing table.

The Final Step: Closing Day

Closing day is the grand finale. It’s when you’ll sign a mountain of paperwork, including all your mortgage documents. One of the most critical documents you’ll sign is the deed of trust. If you want a better handle on this, it’s worth learning what a deed of trust is and how it functions in a Texas transaction.

At the closing appointment, the title company does its final job. They make sure the seller gets their money, the new deed is officially recorded in your name, and your owner’s and lender’s title insurance policies are issued. The moment you walk out that door, you’re not just a buyer—you’re a property owner, with your investment protected for as long as you own your new Dallas property.

Common Title Problems Found in Dallas Properties

To really get what title insurance is, you have to look at the real-world problems it shields you from. Getting a “clean” title report feels great, but the scariest issues are often the ones lurking beneath the surface—things a standard record search just won’t catch. These hidden defects can quickly turn your dream of Dallas property ownership into a legal and financial nightmare.

Let’s walk through a few common scenarios we see right here in Dallas that show exactly how an owner’s policy can be a lifesaver.

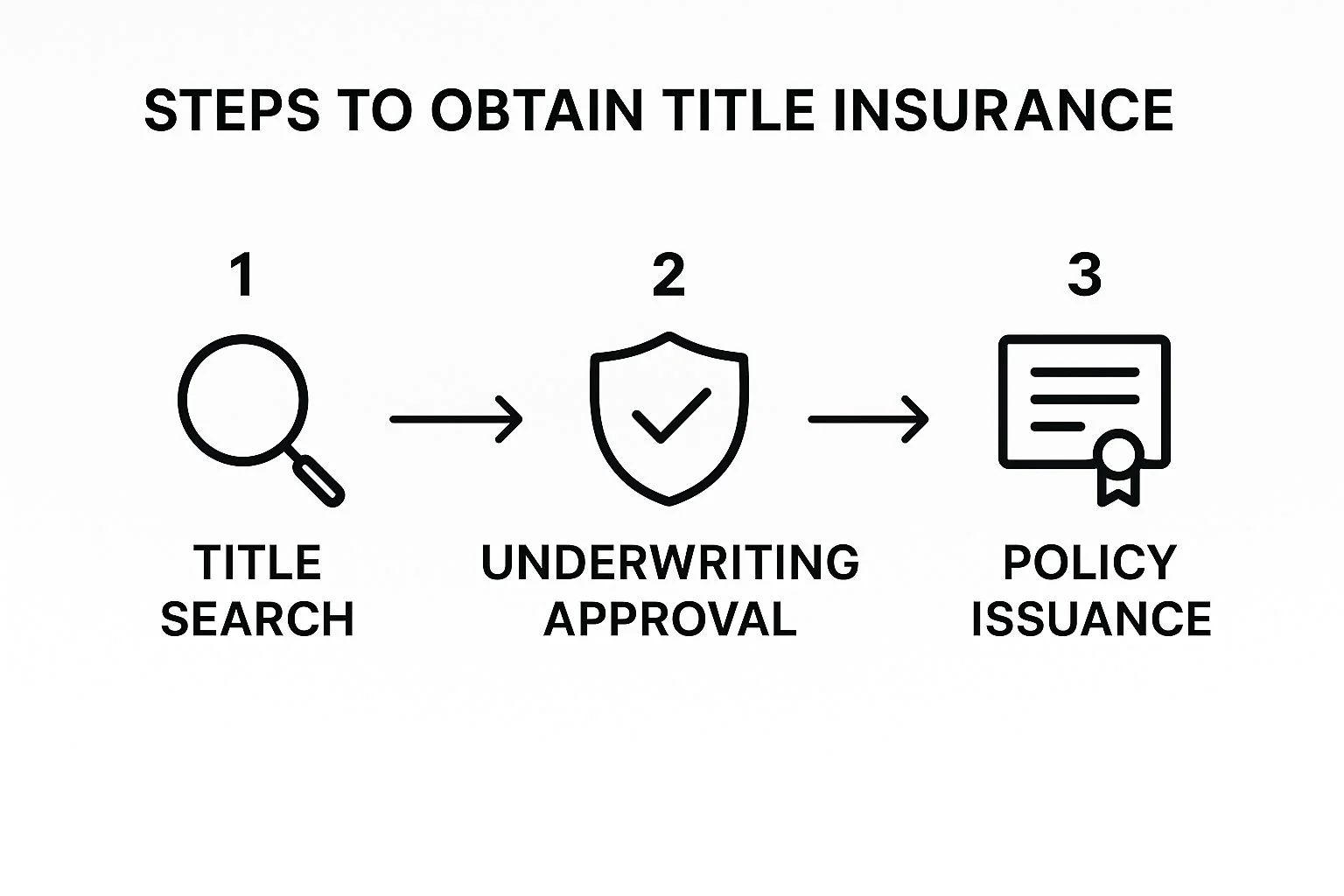

This image breaks down the key steps in getting your title insurance policy secured.

As you can see, the process starts with a deep dive into the property’s history, moves through underwriting, and ends with your final policy being issued, giving you solid protection.

An Unknown Lien from a Past Owner

Picture this: you buy a beautifully updated historic home in Oak Cliff. A year after moving in, you get a notice that a lien has been slapped on your property. It turns out the owner from two sales ago never paid their city property taxes. Without title insurance, that old debt is now your problem.

But with an owner’s policy, you just hand it over to your title company. They’ll verify the claim and pay it off, protecting your investment and making sure your title stays clean. Learning how to remove a tax lien shows just how complicated these situations can get.

Boundary Disputes and Encroachments

Here’s another one. You buy a great house in the M Streets and decide to put up a new fence. You order a survey and discover your neighbor’s garage was built two feet onto your property a decade ago. This is a classic title defect called an encroachment, and it can seriously affect your property’s value and make it hard to sell later on.

Your title insurance policy is designed for exactly this kind of mess. It covers the costs to resolve the issue, whether that involves legal action, a settlement with your neighbor, or compensating you for the loss in property value. If you’re curious about how these issues are found, you can learn more about https://dustinpitts.com/uncategorized/how-to-research-property-history/ and see what goes into a thorough investigation.

Title insurance acts as a safety net against human error, fraud, and undiscovered claims from the past. It transforms a potentially catastrophic financial event into a manageable issue handled by experts.

Common Questions About Title Insurance

Even after getting the basics down, you probably still have a few questions floating around. Let’s tackle some of the most common things Dallas property buyers ask to clear up any lingering confusion.

Is an Owner’s Title Policy Really a “Must-Have” in Texas?

Yes, absolutely. While your lender will require their own policy, that’s just to protect their investment—the loan they gave you. It does absolutely nothing to protect your equity or your right to the property.

Here’s the best part for buyers in Texas: the seller usually pays for the owner’s policy. Think about that—you get a crucial piece of protection for your biggest asset, and it often costs you nothing out of pocket. Without it, you’d be on the hook for every penny of legal fees if an old title issue suddenly pops up.

How Long Am I Covered by Title Insurance?

This is one of the most powerful features of an owner’s policy. Your coverage lasts for as long as you or your heirs own the property. It’s a one-time fee paid at closing that protects you for life.

On the flip side, a lender’s policy is only active for the life of the loan. The moment you make that final mortgage payment, their coverage disappears. Your owner’s policy is what continues to stand guard over your investment.

Can I Pick My Own Title Company in Dallas?

You certainly can. As the buyer, you have the right to choose which title company handles your closing. Your real estate agent or even the seller might have a preferred company, but the final decision is yours.

It’s always a good idea to do a little research and choose a reputable Dallas title company you feel comfortable with. This is the team that’s going to be protecting your ownership rights, so picking a partner you trust is a smart move that pays dividends in peace of mind.

Navigating the Dallas real estate market requires expert guidance. The team at Dustin Pitts REALTOR Dallas Real Estate Agent is here to ensure every aspect of your purchase, including title and closing, is handled with precision and care. Contact us today to get started.