Buying your first home in Dallas feels like a huge milestone, and it is! But the journey doesn’t start with scrolling through Zillow or hitting up open houses. It begins with something a little less glamorous but way more important: getting a firm grip on your finances. You need a realistic budget to understand exactly what you can afford in this fast-paced market.

How to Prepare for Your First Dallas Home Purchase

Getting ready to buy your first place in Dallas means putting together a rock-solid financial game plan. We’re talking about more than just saving for a down payment. It’s about seeing the whole financial picture—getting your credit score in shape, factoring in all the Dallas-specific costs, and digging into local programs that can make owning a home more affordable. Think of it as your pre-market financial boot camp.

The Dallas-Fort Worth area is a magnet for growth, and that directly impacts what it’s like to buy a home here. The metroplex population exploded from 7.6 million to 8.1 million between 2020 and 2023 alone, pushing the number of households to 3.1 million. This incredible demand supports a solid homeownership rate of 59.9% and is expected to fuel a 27% jump in mortgage purchase loan volume by 2026. That’s nearly $11 billion in new loan activity, which shows just how dynamic this market is. For a deeper dive, check out this Dallas mortgage forecast.

Build Your Dallas-Specific Budget

First things first: you need a budget that reflects the real cost of homeownership in Dallas. Those online mortgage calculators are a decent starting point, but they rarely tell the full story. They often gloss over the local nuances that can drastically change your monthly payment.

Here’s what you absolutely must factor in beyond your basic principal and interest:

- Property Taxes: Let’s be real—Texas property taxes are no joke. They’re some of the highest in the country, often between 2% to 2.5% of your home’s assessed value each year. On a $350,000 house in Dallas County, you could be looking at an extra $600-$730 tacked onto your monthly payment.

- Homeowner’s Insurance: Thanks to our classic Texas weather—hailstorms, high winds, you name it—insurance premiums can be higher here. It’s a smart move to get some quotes early on so you’re not surprised.

- HOA Fees: From the sleek townhome communities in The Cedars to the sprawling suburban developments up in Frisco, many Dallas neighborhoods have a Homeowners Association. These fees can run from a small monthly amount to several hundred dollars.

A huge mistake I see first-time buyers make is underestimating these “hidden” costs. When you account for taxes, insurance, and potential HOA fees right from the start, you get a much clearer picture of your true buying power and can avoid that dreaded budget shock down the road.

Strengthen Your Credit Score

Think of your credit score as your most powerful negotiating tool. A higher score proves to lenders that you’re a responsible borrower, and they’ll reward you with a lower interest rate on your mortgage. Even a small drop in your rate can save you tens of thousands of dollars over the life of your loan. It’s a big deal.

Ready to give it a boost? Here are a few practical steps:

- Pay every single bill on time. No exceptions.

- Keep your credit card balances as low as possible, ideally under 30% of your available credit.

- Don’t open any new credit cards or take out other loans right before or during your home search.

Even a slight improvement in your score can open up much better loan options.

Save for Your Down Payment and Closing Costs

Saving up for a down payment is often the biggest hurdle for a first time home buyer in Dallas, TX. And while you’ve probably heard you need a 20% down payment to avoid Private Mortgage Insurance (PMI), that’s not always the case. Plenty of conventional loans let you put down as little as 3-5%.

But don’t stop there. You also need to budget for closing costs. These are all the fees required to finalize your loan and legally transfer the property to your name. In Dallas, these costs typically run between 2% and 5% of the home’s purchase price. For that same $350,000 home, that’s an extra $7,000 to $17,500 you’ll need to have ready.

By getting prepared for all these expenses, you’ll walk into the Dallas real estate market with the confidence and clarity you need to make a smart, successful investment.

Making Sense of the Current Dallas Housing Market

Trying to buy your first home in Dallas without understanding the market is like playing a game without knowing the rules. The goal isn’t to perfectly time the market—that’s a fool’s errand. Instead, it’s about knowing the current conditions so you can make smart, confident moves.

Is it a buyer’s market or a seller’s market? How fast are homes really selling? Answering these questions helps you build a winning strategy.

The DFW real estate scene is always in motion, influenced by everything from local job growth in Plano to national interest rate changes. As a first-time home buyer in Dallas, TX, your ability to read these trends gives you a huge advantage. It’s the difference between spotting a great deal, overpaying in a hot area, or knowing when you have the upper hand in negotiations.

What to Watch: Key Market Indicators

To get a real feel for the Dallas market, you need to look past the headlines and focus on a few core numbers. These metrics tell the true story of supply and demand, which is what really impacts your buying power.

-

Inventory Levels: This is simply the number of homes available for sale. When inventory is low, you’re competing with more buyers, which often sparks bidding wars. When inventory is high, you have more options and more room to negotiate.

-

Median Home Prices: Watching whether prices are climbing, dropping, or holding steady is a direct reflection of buyer demand and overall market health. It’s your best gauge for affordability.

-

Days on Market (DOM): This tells you the average number of days a home is listed before the seller accepts an offer. A low DOM means you need to be ready to act fast. A higher DOM suggests a slower pace, giving you more time to think.

A massive shift hit the market in early 2025, swinging the pendulum firmly toward homebuyers. In a complete reversal from the frenzy of previous years, housing inventory across Dallas-Fort Worth ballooned by 53% above normal levels. By April 2025, there were roughly 123,000 active listings on the market.

This oversupply gave buyers unprecedented leverage. As a result, an incredible 66% of homes sold in March 2025 went for under their original asking price.

Turning Market Shifts into Your Opportunity

A changing market isn’t a reason to panic; it’s an opportunity to act. When the market cools and inventory piles up—like it has recently—it creates new openings for buyers who are ready to jump.

For instance, with more houses to compete against, sellers have to work harder to make their property stand out. This gives you more power at the negotiating table. You might be able to get a better price, convince the seller to cover some of your closing costs, or get them to agree to repairs you found during the inspection. In a seller’s market, those requests are often dead on arrival.

Key Takeaway: Remember that “the market” isn’t a single thing. Conditions can be wildly different from one neighborhood to the next. A perennially popular area like the M Streets might stay competitive even when the broader Dallas market cools off. This is why working with an agent who truly knows these local micro-markets is so critical.

For a deeper dive into these trends, check out our Dallas 2024 housing insights and buyer’s guide.

The table below gives you a quick snapshot of what these recent market changes really mean for you as you start your search.

Dallas-Fort Worth Housing Market Key Indicators

The recent shifts in the DFW housing market have created a more favorable environment for first-time buyers. This table breaks down what’s happening and how it impacts you directly.

| Market Indicator | Recent Trend | Impact on First-Time Buyers |

|---|---|---|

| Housing Inventory | Significantly Increased | More homes to choose from and less competition, reducing the likelihood of bidding wars. |

| Home Prices | Stabilizing/Slightly Decreasing | Increased affordability and a lower risk of overpaying in a frenzied market. |

| Days on Market | Lengthening | More time to tour homes, consider your options, and conduct thorough due diligence without feeling rushed. |

| Seller Concessions | Becoming More Common | Greater opportunity to negotiate for seller contributions toward closing costs or rate buy-downs. |

By staying on top of these dynamics, you can adapt your game plan and use the current market to your advantage. It puts you in a much stronger position to land your first home in Dallas.

Finding Your Ideal Dallas Neighborhood

Dallas isn’t just one city; it’s a sprawling patchwork of unique neighborhoods. Each one has its own distinct personality, price point, and way of life. For any first time home buyer in Dallas, TX, the most important part of the journey is moving beyond a generic online search and really getting to know these areas. This is how you find a place that truly feels like home.

It’s about so much more than the number of bedrooms or the square footage. It’s about finding a community that clicks with your day-to-day life. Believe me, even the most perfect house will lose its shine fast if you’re stuck in a nightmare commute or the local scene just isn’t your speed.

The real work starts when you begin to connect your personal wish list and financial reality to actual spots on the Dallas map.

Beyond the Price Tag: What Really Matters

While your budget is obviously a huge factor that will narrow your search, the “best” neighborhood is defined by the things that shape your everyday experience. As you start exploring, get serious about these critical elements:

- Your Daily Commute: How much of your life are you willing to spend in the car or on the DART rail? Don’t just look at a map; test it. Drive the route from a potential neighborhood to your job during rush hour. A 15-mile trip looks a lot different at 8 AM than it does at 2 PM.

- Lifestyle and Amenities: Do you dream of walking to a coffee shop every morning and having vibrant nightlife just around the corner? Or are you looking for quiet, tree-lined streets with easy access to parks and trails? Be brutally honest about what you’ll actually use and enjoy.

- Future Development: What’s on the horizon for the area? Look into plans for new retail centers, infrastructure upgrades, or park expansions. These kinds of projects can dramatically improve your quality of life and boost property values down the road.

Thinking through these practical details helps you build a crystal-clear picture of what you’re looking for, which makes the entire home search more focused and a lot less overwhelming.

A Snapshot of Popular Dallas Areas

Dallas has a fantastic range of neighborhoods that are perennial favorites for first-time buyers. Each one caters to different budgets and priorities with its own unique character.

Bishop Arts District & Oak Cliff

This area is the heart of independent, creative Dallas. Known for its one-of-a-kind boutiques, art galleries, and fantastic restaurants, Bishop Arts offers a super walkable environment. It’s a perfect fit if you crave a strong sense of local culture right at your doorstep.

East Dallas & Lakewood

If you’re an outdoorsy person, this should be at the top of your list. The area is built around the beautiful White Rock Lake, which means you have incredible access to green space and miles of trails. The homes here range from charming historic bungalows to cool, updated mid-century ranches. To get a real feel for it, you can explore this detailed East Dallas home guide and learn how to navigate the market.

The Northern Suburbs (Plano & Frisco)

For buyers who prioritize top-tier public schools, getting more square footage for their money, and a classic suburban lifestyle, heading north is a common move. These cities are practically destinations in their own right, with master-planned communities, tons of amenities, and major corporate headquarters.

Your real estate agent should be more than just a door-opener; they should be your neighborhood expert. A great agent can provide invaluable insights on local market trends, school district reputations, and even which streets have the best community vibe—details you’ll never find on a national listing site.

Digging Deeper with Local Data

Once you’ve zeroed in on a few potential neighborhoods, it’s time to get granular. There are two key data points every first time home buyer in Dallas, TX, needs to investigate: property taxes and crime rates.

- Property Tax Rates: As we’ve covered, Texas property taxes are no joke. But they aren’t uniform. The rates vary significantly by city, county, and especially by school district. A house in one suburb might have a tax rate of 2.5%, while a nearly identical home a few miles away in a different ISD could be closer to 2.0%. That difference can easily add up to thousands of dollars every year.

- Safety and Crime Statistics: Feeling safe in your new home is non-negotiable. Use the online resources provided by the Dallas Police Department or other local city police departments to look up crime stats for the specific areas you’re considering. Pay attention to the trends over time, not just a single snapshot.

This kind of detailed research might feel a little tedious, but it’s what turns a hopeful house hunt into a smart, strategic investment. When you carefully weigh all these lifestyle and financial factors, you’re not just buying a property—you’re choosing a community where your investment can truly thrive.

Crafting a Winning Offer and Navigating Inspections

You’ve explored Dallas neighborhoods, you’ve toured countless homes, and now it’s happened—you’ve found the one. That house that just feels right. This is where the real strategy begins.

Making a competitive offer and handling the inspection are two of the most critical hurdles for any first time home buyer in Dallas, TX. Get these right, and you could save yourself thousands and a world of headache. It’s time to turn all that searching and saving into a successful purchase.

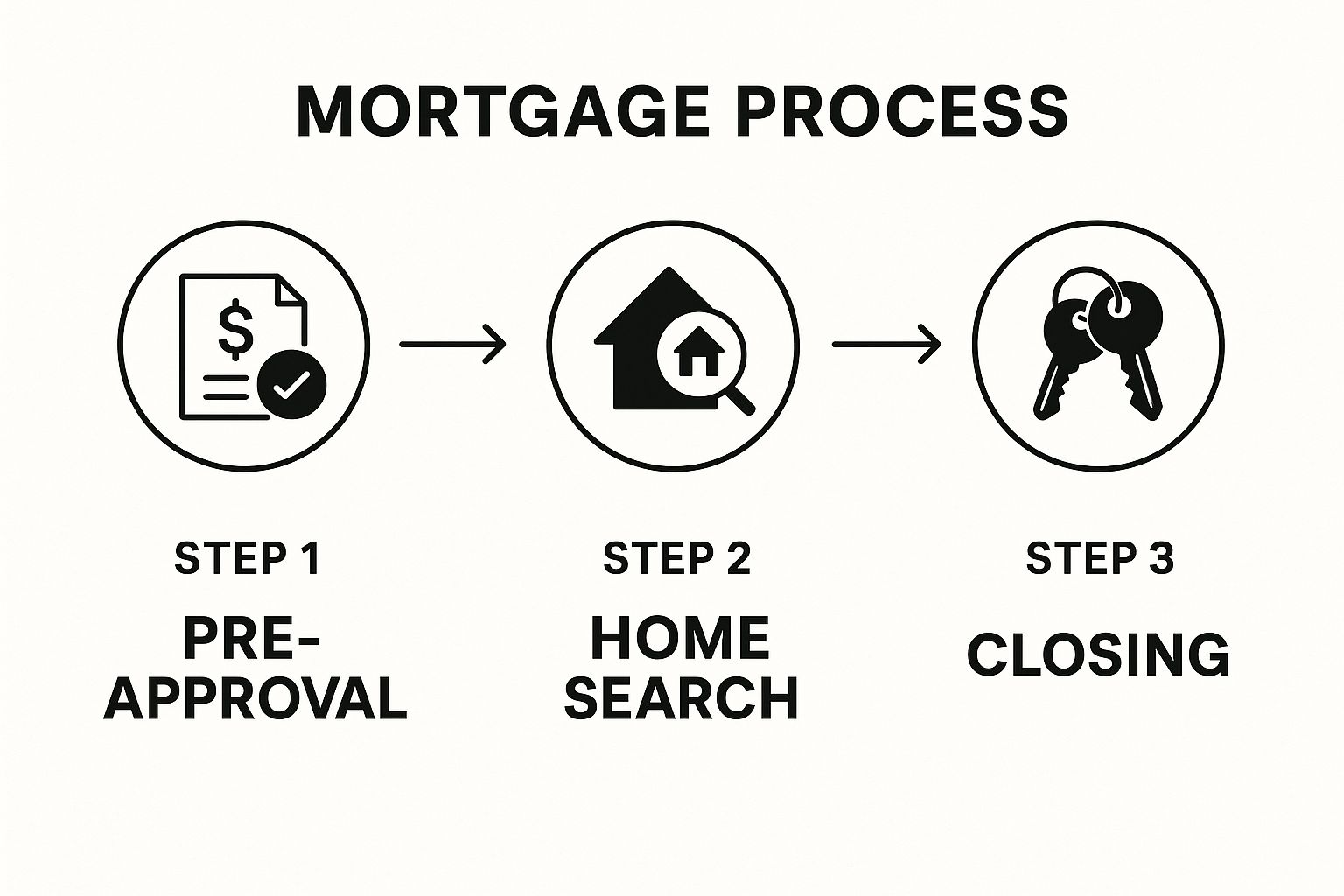

This handy infographic lays out the entire journey, from getting your financing squared away to finally getting those keys at closing.

As you can see, that pre-approval isn’t just a piece of paper; it’s the foundation that gives you the credibility and confidence to move forward.

Structuring Your Offer

An offer is so much more than just the price. Think of it as a complete proposal to the seller, and in a market as dynamic as Dallas, how you put that proposal together can make all the difference.

Your agent will start by analyzing “comps”—comparable sales of similar homes that recently sold nearby—to land on a fair price. But the market itself tells a huge part of the story.

Early 2025 data, for instance, showed a fascinating shift. While the median Texas home price nudged up slightly by 0.3% to $331,000, the real news was the inventory. Active listings across the state shot up by a massive 30.7%! This trend hit Dallas-Fort Worth hard, flooding the market with more available homes. Properties also sat longer, with the statewide average days on market climbing to 72 days. You can discover more about these statewide housing trends and what they signal for buyers.

What does this mean for you? Leverage. In a red-hot seller’s market, you might have to offer over asking price. But in a market with higher inventory, you have more room to negotiate. You might be able to offer at or even below the list price, especially if the home has been on the market for a while.

The Power of Contingencies

Contingencies are your escape hatches. They are conditions built into your offer that must be met for the sale to proceed, and they’re your primary safety net. For a first-time buyer, two are absolutely essential:

- Financing Contingency: This simply says your offer is dependent on you actually getting the mortgage. If your loan falls through for any reason, this clause lets you back out of the contract and get your earnest money back.

- Appraisal Contingency: Your lender will only give you a loan for what the home is professionally appraised for. If the appraisal comes in lower than your offer price, this contingency protects you from overpaying and allows you to renegotiate or walk away.

A word of caution: In a bidding war, some buyers might waive contingencies to make their offer look more appealing. For a first-time buyer, this is an incredibly risky gamble. These clauses are your best protection against a massive financial mistake.

Navigating the Home Inspection

Once your offer is accepted, the clock starts on your inspection period. This is your chance to bring in a licensed professional to do a deep dive into the home’s true condition, from the foundation right up to the roof.

Here in the Dallas area, inspectors often find a few common culprits:

- Foundation Movement: North Texas is famous for its expansive clay soil, which can cause foundations to shift and settle. An inspector will hunt for tell-tale signs like cracks in the brick or drywall and doors that don’t close properly.

- Roof Damage: Hailstorms are just a part of life here. A thorough roof inspection will check for hail damage, missing shingles, and the roof’s remaining lifespan.

- HVAC Systems: With our scorching summers, a healthy air conditioning system is non-negotiable. The inspector will check the age, condition, and performance of the unit.

The final inspection report can look intimidatingly long, but don’t panic. No home is perfect, not even new construction. The goal isn’t to find a flawless house, but to identify any major, deal-breaking, or expensive problems.

Armed with that report, you generally have three paths forward:

- Ask the seller to make specific repairs.

- Negotiate for a credit toward your closing costs so you can handle the repairs yourself.

- Walk away from the deal if the problems are too big (and your contract allows for it).

The inspection is one of your most powerful negotiation tools. A major issue, like an AC unit on its last legs, can become powerful leverage to get a better price or a hefty credit from the seller, turning a potential roadblock into a financial advantage.

Your Guide to the Texas Closing Process

So, you got the call—your offer was accepted! After navigating the inspections, you’re now in the home stretch. This is the closing period, and for a first time home buyer in Dallas, TX, it can feel like a whirlwind of paperwork and waiting. But don’t worry, this is where all the pieces come together to officially hand you the keys.

This final phase usually takes about 30 to 45 days. While it might feel quiet on your end, behind the scenes, your team—your agent, lender, and the title company—is working full tilt to get everything squared away. Think of it as the backstage crew setting the stage for the big finale: closing day.

The Key Players in Your Closing

Getting to the closing table is a team sport. While your real estate agent is your main guide, two other key players are working hard to finalize your purchase.

- The Lender: Their main focus is on finalizing your loan. They’ll order an appraisal to make sure the home’s value matches the price, do one last check on all your financial documents, and prep the massive stack of loan paperwork you’ll sign at closing.

- The Title Company: In Texas, the title company acts as a neutral third party. Their job is crucial: they dig into the property’s history, make sure the seller can legally sell it, and handle the secure exchange of money and documents on closing day.

Understanding the Title Search and Title Insurance

Before you can truly own a home, the title company has to perform a deep dive called a title search. They comb through public records to verify the seller’s right to the property and to uncover any potential problems, like unpaid taxes, liens from contractors, or old ownership disputes that could come back to haunt you.

This search leads to one of the most important things you’ll buy: title insurance. It’s a one-time fee you pay at closing, but it protects your ownership rights for as long as you have the house. If a long-lost heir or a hidden claim from a previous owner suddenly appears down the road, your title insurance policy steps in to defend your ownership.

In a city like Dallas, with its mix of historic and new properties, title insurance is an absolute must. It’s a small price to pay for the peace of mind of knowing your biggest investment is truly yours.

Breaking Down Your Closing Disclosure

Roughly three business days before you’re scheduled to close, your lender will send you a document called the Closing Disclosure (CD). This is it—the final, official breakdown of your loan terms and all the costs involved. It’s your last chance to review every single number.

Your five-page CD will clearly lay out:

- Your final loan amount, interest rate, and what your monthly payment will be.

- A detailed, itemized list of your closing costs (think lender fees, appraisal costs, title services, etc.).

- The exact amount of cash you need to have ready for closing day.

Treat this document like your financial final exam. Pull out the Loan Estimate you got at the beginning and compare them side-by-side. If a number looks off or you don’t understand a fee, speak up! Now is the time to get clarity from your lender.

The Final Walkthrough

Right before you head to the closing table, typically the day before or the morning of, you get to do one last walkthrough of the property. This isn’t another inspection; it’s your opportunity to make sure the house is in the same condition you agreed to buy it in.

I always tell my clients to bring a simple checklist. You’re looking for a few key things:

- Check Agreed-Upon Repairs: Make sure the seller completed any repairs they promised, and that the work looks good.

- Test Everything: Flip the light switches, run the HVAC for a minute, turn on the faucets, flush the toilets, and test any appliances that are staying.

- Look for New Damage: Keep an eye out for any new issues, like dings in the walls or scratches on the floor that might have happened when the sellers moved out.

This final check ensures there are no unpleasant surprises. Once you’re satisfied, you can head to your closing appointment feeling confident, ready to sign the papers, and finally get the keys to your new Dallas home.

Common Questions from Dallas First-Time Buyers

The home buying process is a whirlwind of questions. If you’re a first-time home buyer in Dallas, TX, those questions get even more specific. You’re probably wondering about our unique tax situation, how much cash you really need for closing, and which assistance programs are actually worth your time.

Getting straight, honest answers is the key to moving forward with confidence. Below, we’ll tackle some of the most common concerns we hear from new buyers navigating the Dallas market.

Of course, this is just a snapshot. The journey is packed with details, and it’s totally normal to feel a bit overwhelmed. For a complete step-by-step look, our first-time homebuyers’ guide to success in Dallas offers a much deeper dive into the entire process.

What Are Property Taxes Really Like in Dallas?

This is often the first—and most important—question people ask. Let’s be direct: property tax rates in Dallas County and the surrounding metroplex are noticeably higher than the national average. You can generally expect your annual tax bill to be somewhere between 2% and 2.5% of your home’s assessed value.

It’s crucial to understand this isn’t a single tax. It’s a combination of rates from the county, the city, the local school district (like Dallas ISD), and sometimes other groups like a community college. This means a home in one part of Dallas might have a completely different tax rate than a similar one just a few miles away in a different school district. This is a critical line item to factor into your monthly housing budget from day one.

How Much Should I Actually Budget for Closing Costs?

“Closing costs” is a catch-all term for the collection of fees you pay to finalize the deal. They cover everything from your lender’s administrative fees and the property appraisal to title insurance and attorney services.

Here in Dallas, a safe rule of thumb is to budget between 2% and 5% of the home’s final purchase price for your closing costs. Why such a wide range? Because some fees are fixed, while others fluctuate based on your lender and the price of the home.

Let’s make that real. On a $350,000 house in Dallas, your closing costs would likely land somewhere between $7,000 and $17,500. That’s a significant chunk of cash you’ll need ready to go, on top of your down payment.

Are There Any Good Assistance Programs in Dallas?

Absolutely! It’s a huge mistake to assume you won’t qualify for help without checking. Both the city and the state offer fantastic programs designed to make homeownership more attainable for first-time buyers.

Here are a few you should definitely look into:

- Dallas Homebuyer Assistance Program (DHAP): This is a city-run program that provides real, tangible help with your down payment and closing costs. For many buyers, DHAP is the final piece of the financial puzzle.

- My First Texas Home: This is a statewide program from the Texas Department of Housing and Community Affairs (TDHCA). It offers flexible assistance that can be used anywhere in Dallas.

- Mortgage Credit Certificate (MCC): This one is a game-changer. It’s a federal tax credit administered by the state that gives you a dollar-for-dollar reduction on your federal income taxes. We’re talking thousands in savings over the life of your loan, and you can often stack it with other assistance programs.

These programs exist to help you bridge the financial gap. Exploring them isn’t just a good idea—it’s a vital step for any first-time buyer in the Dallas market.

Navigating the Dallas real estate market requires local expertise and a guide you can trust. At Dustin Pitts REALTOR Dallas Real Estate Agent, we specialize in helping first-time buyers find their perfect place in this dynamic city. If you’re ready to start your journey, let’s connect. Visit us at https://dustinpitts.com to learn more.

Article created using Outrank