Before you even start scrolling through listings, the real work of finding a great Dallas investment property begins. I’ve seen too many new investors jump the gun. The secret? You need to lock down two things first: your specific investment strategy and the right kind of financing. Getting this foundation in place before you search means you can pounce on a great deal with confidence in this fast-moving Dallas market.

Building Your Dallas Investment Foundation

Before you can even think about how to find investment properties, you have to build a solid plan. Seriously. The most successful investors I know in Dallas aren’t just hunting for “good deals”—they’re looking for properties that perfectly match a goal they’ve already defined.

So, your first real step is getting crystal clear on what you want to accomplish. This clarity will tell you exactly where to look and what to look for. Are you playing the long game for appreciation, or is immediate cash flow king? The answer changes everything for your Dallas property search.

Define Your Dallas Investment Strategy

An investor chasing high appreciation might zero in on rapidly gentrifying Dallas neighborhoods like Bishop Arts or the up-and-coming areas circling downtown. In this scenario, you’re betting on future growth, even if the initial cash flow isn’t spectacular.

On the other hand, if you’re all about that strong monthly cash flow, you might hunt for multi-unit properties near a major university like SMU or UT Dallas. The constant demand from students can provide a very reliable income stream. Another solid cash-flow play is looking at established Dallas suburbs like Garland or Mesquite, where you can often buy properties for less relative to what they’ll rent for.

Your investment strategy should be a simple, written document covering a few key points:

- Target Property Type: Are you after a single-residence home, a duplex, a quadplex, or something else entirely in Dallas?

- Ideal Neighborhood Profile: Do you want an appreciating Dallas neighborhood, a high-demand rental area, or a stable cash-flow suburb?

- Financial Goals: What’s your target cash-on-cash return? Or what’s the minimum monthly income you need to see?

A clear, written strategy is your North Star. It keeps you from getting distracted and chasing shiny objects that don’t actually move you closer to your financial goals. It’s a classic rookie mistake in a hot market like Dallas.

Align Your Financing in Advance

Once your strategy is set, your next move is to get your financing lined up. And I don’t just mean getting a generic pre-approval letter. You need to find and connect with a Dallas-based mortgage broker who truly specializes in investment property loans.

These lenders get the nuances of non-owner-occupied financing. They know how to structure a loan that fits your specific plan, which is totally different from a standard home loan.

Getting your financing fully aligned means you know your real budget, not just some theoretical number on a pre-approval. This gives you the power to walk into a deal and make a strong, confident offer the second you find the right opportunity in North Texas.

Understanding how to acquire the property is just the beginning. To ensure your investment thrives long-term, it’s wise to explore various strategies for making your property investment a success.

How to Source Deals Across the DFW Metroplex

Once your investment strategy is set, the real work begins: learning how to find investment properties in Dallas that everyone else overlooks. In a market as white-hot as Dallas, the best deals aren’t the ones that have been sitting on the MLS for weeks. They’re discovered through a mix of smart networking and old-fashioned hustle.

If you’re only looking at public listings, you’re already behind. You’re swimming in the same crowded pool with every other buyer in Dallas. To truly get an edge, you have to go where the competition isn’t. This means building a pipeline that brings opportunities to you, often before they hit the open market.

Partnering with Investor-Focused Agents

Your first and most important move is to find a Dallas real estate agent who actually specializes in investment properties. I can’t stress this enough—not all agents are cut from the same cloth. You need someone who has deep roots in the Dallas communities you’re targeting, whether it’s Plano or Frisco, and who genuinely understands an investor’s mindset.

A true investor-focused agent brings so much more to the table than just MLS access.

- Pocket Listings: They hear about Dallas properties before they’re ever listed publicly. These are the golden opportunities.

- Network Access: They have a go-to list of contractors, property managers, and other key players you’ll need in Dallas.

- Market Insight: They have on-the-ground knowledge of which streets are hot, which Dallas neighborhoods are on the upswing, and where the best rental yields are hiding.

A great agent lives and breathes the DFW market. They can spot a potential gem from a mile away. This partnership is easily one of the most powerful tools in your deal-sourcing arsenal.

Tapping into Off-Market Opportunities

Beyond your agent, the savviest Dallas investors are actively hunting for off-market deals. These are properties for sale that you won’t find on the MLS. This is where you find motivated sellers and sidestep the bidding wars.

The real secret to consistent deal flow in Dallas isn’t waiting for deals to appear; it’s creating a system to uncover them. This proactive stance separates amateur investors from professional ones.

One of the most effective, tried-and-true methods is “driving for dollars.” It’s as simple as it sounds. You systematically drive through your target Dallas neighborhoods looking for properties that look distressed or neglected—think overgrown lawns, boarded-up windows, or mail piling up.

Jot down the address, then use public records to find the owner’s contact information. A simple, polite inquiry about whether they’d consider selling can open doors you never knew existed. This strategy is incredibly powerful in transitioning areas like Oak Cliff or parts of East Dallas. To zero in on the right areas, check out our Dallas real estate guide to top neighborhoods to match locations with your specific criteria.

Building Your Network with Wholesalers and REIAs

Finally, you need to immerse yourself in the local DFW investment scene. That means connecting with two crucial groups: wholesalers and other investors at Real Estate Investment Association (REIA) meetings.

Wholesalers are the ultimate boots-on-the-ground operators in Dallas. They specialize in sniffing out off-market properties, putting them under contract, and then assigning that contract to an end-investor (like you) for a fee. Building relationships with a few reputable Dallas wholesalers can create a steady stream of potential deals delivered straight to your inbox.

On top of that, showing up to local Dallas REIA meetings puts you in a room filled with hundreds of other investors, lenders, and contractors. These events are absolute goldmines for building your network, picking up new strategies, and even finding partners for your next Dallas deal.

Running the Numbers on a Dallas Property

Once you’ve zeroed in on a promising Dallas property, the real work begins. It’s time to take off the “property hunter” hat and put on your “financial analyst” cap. This is the moment where seasoned investors separate emotion from pure economics—a crucial skill if you want to find deals that actually make you money in Dallas.

A property can look perfect on paper, but if the numbers don’t hold up under scrutiny, it can become a real headache. Gut feelings are great for picking a restaurant, not a Dallas investment.

Every successful investment is built on a solid foundation of data. You need to dig deep and verify every assumption, from what you can realistically charge for rent to the often-overlooked local costs that are unique to the Dallas market.

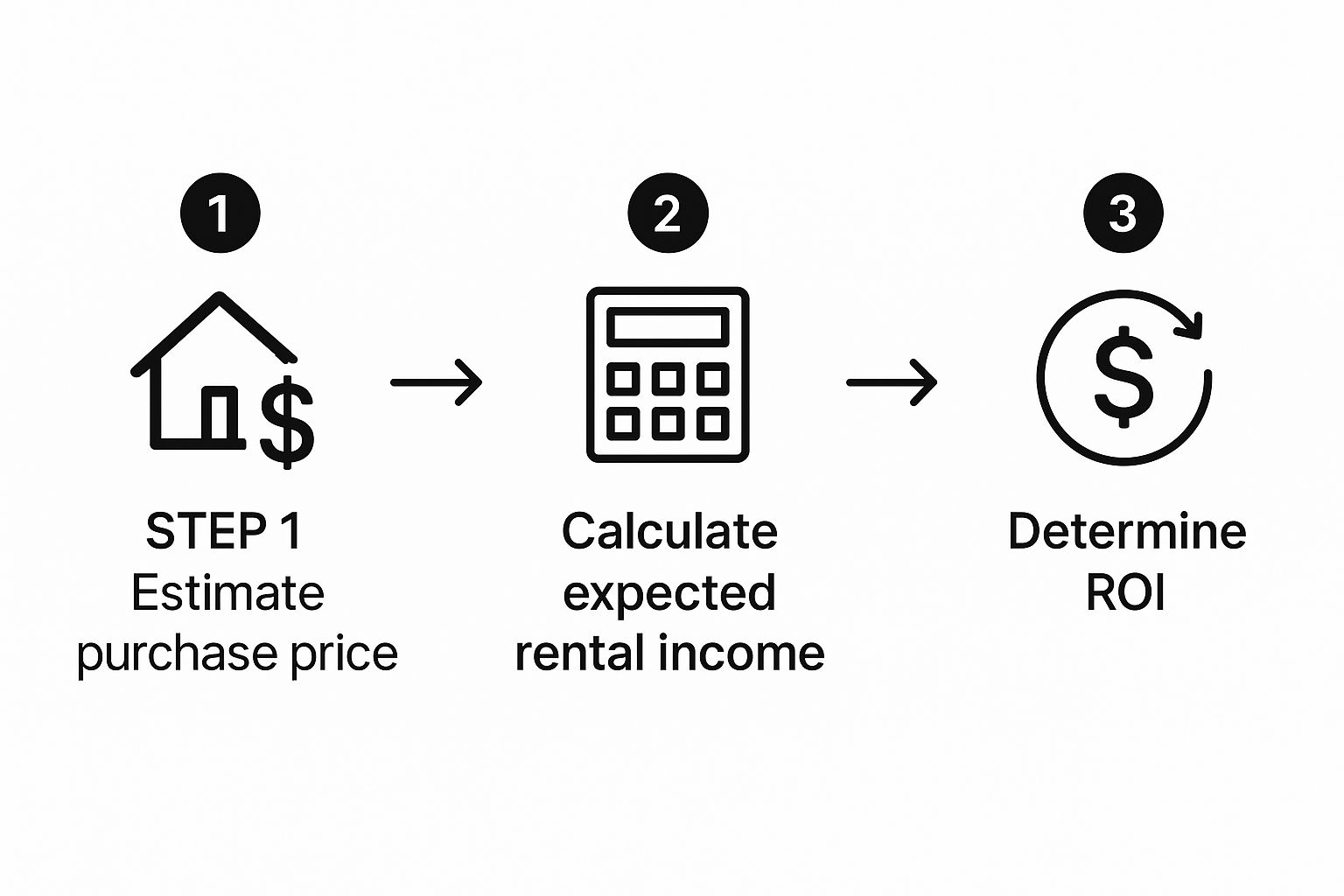

This visual guide breaks down the essential flow for evaluating a Dallas property, from the initial purchase price all the way to your final return.

Following a process like this ensures your decisions are driven by data, not emotion. That’s the true cornerstone of building a profitable Dallas real estate portfolio.

Calculating Your True Dallas Expenses

One of the most common pitfalls for new investors is underestimating just how much it costs to operate a rental in Dallas. In Dallas, certain expenses like property taxes and insurance can be particularly hefty and need your full attention. Get these wrong, and your cash flow could disappear.

- Property Taxes: Let’s be blunt: North Texas has some of the highest property tax rates in the nation. Don’t ever rely on the seller’s current tax bill. As soon as you buy, Dallas County will likely reassess the property’s value closer to your purchase price. A safe bet is to budget 2.2% to 2.5% of the home’s value for taxes each year.

- Insurance: This is another big one. Costs can swing wildly depending on the property’s age, what it’s made of, and its exact location within Dallas County. Always, always get a real insurance quote during your option period. For a typical single-residence rental, budgeting $2,500 to $4,000 annually is a reasonable place to start, but get a hard number.

- Vacancy and Repairs: Things break. Tenants move out. It’s part of the business. A smart investor always budgets for this reality. Plan on setting aside 5-8% of the gross monthly rent for vacancies and another 5-8% for maintenance and repairs.

Ignoring these Dallas-specific costs is a recipe for disaster. What looks like a great deal can quickly turn into a money pit.

The numbers you run before buying a Dallas property are the most important numbers you’ll ever look at. They predict your future success or failure with that asset. Don’t just glance at them—interrogate them.

Key Performance Metrics for Dallas Investors

Once you’ve got a realistic handle on the expenses, you can start calculating the key metrics that tell you whether a Dallas property is a winner or a dud. These numbers cut through the fluff and give you a clear, objective way to compare different opportunities side-by-side.

A critical part of this is knowing what to look for. If you’re new to this, sharpening your skills by learning about analyzing real estate investment deals is time well spent.

Two of the most important numbers on your spreadsheet will be the Capitalization Rate (Cap Rate) and the Cash-on-Cash Return.

- Capitalization Rate: This metric gives you a snapshot of the property’s return without factoring in your loan. You calculate it by dividing the Net Operating Income (NOI) by the purchase price. In Dallas, a “good” cap rate can fall anywhere between 5% and 7%, depending heavily on the neighborhood and its potential for appreciation. A property in a stable area like Richardson will have a different cap rate profile than one in an up-and-coming area like The Cedars.

- Cash-on-Cash Return: For most investors using a mortgage, this is the number that matters most. It tells you how hard your actual invested cash is working for you. You find it by measuring the annual pre-tax cash flow against the total cash you put in (down payment, closing costs, and any initial rehab money). For the Dallas market, a strong Cash-on-Cash (CoC) return is generally anything 8% or higher.

To help you keep everything straight during your due diligence, I’ve put together a simple checklist for Dallas properties. Use this as a quick reference to make sure you’re not missing any critical steps in your analysis.

Dallas Investment Property Analysis Checklist

| Analysis Step | Key Metric / Action | Dallas-Specific Consideration |

|---|---|---|

| Income Verification | Verify current rents; Research market rent comps | Rents vary significantly by submarket (e.g., Bishop Arts vs. Far North Dallas). |

| Expense Calculation | Get actual quotes for insurance & property management | Budget 2.2%-2.5% for property taxes; expect high insurance premiums in Dallas. |

| Contingency Budgeting | Allocate 5-8% for vacancy, 5-8% for repairs | Factor in age of home—older homes in East Dallas may need larger repair funds. |

| Loan & Financing | Secure pre-approval; Calculate monthly PITI | Interest rates directly impact your Cash-on-Cash Return. |

| Performance Metrics | Calculate Cap Rate & Cash-on-Cash Return | Aim for a Cap Rate of 5%-7% and a CoC Return > 8% in Dallas. |

| Neighborhood Analysis | Assess appreciation potential, school ratings, crime rates | Is it a stable Dallas area like Plano or an appreciating one like West Dallas? |

This kind of detailed financial breakdown is non-negotiable for Dallas real estate. It’s what separates the speculators from the serious investors who consistently build wealth. Run the numbers, trust the data, and you’ll be well on your way to making a smart investment in Dallas.

Getting a Feel for the Current Dallas Market

Finding a great-looking house in Dallas is the easy part. The real challenge? Making sure that great-looking house isn’t sitting in a market that’s about to tank. A fantastic property in a declining area is a losing bet from the moment you sign the papers.

To truly succeed in finding investment properties, you have to look beyond the curb appeal. It’s about understanding the powerful economic currents shaping Dallas real estate right now. This bigger picture helps you put your money where the growth is and avoid risks before they even become problems.

Corporate Moves are Creating Dallas Rental Hotspots

Dallas has become a massive magnet for big companies moving their headquarters or expanding their operations. When a major corporation brings thousands of jobs to Dallas suburbs like Plano, Irving, or Frisco, it sets off a chain reaction in the DFW rental market. Suddenly, you have a huge influx of professionals all looking for quality places to live, creating immediate and lasting demand.

As an investor, your job is to get ahead of this wave. Don’t just look at where companies are today; track where they’re going. Following these corporate relocation announcements gives you a massive head start in pinpointing Dallas neighborhoods that are about to see a spike in rental demand and property values.

For a more granular look at what’s happening on the ground, our Dallas real estate trends analysis breaks down the specific local data that can help you sharpen your investment strategy.

How the Bigger Economic Picture Affects DFW

While local job growth is a huge piece of the puzzle, you can’t afford to ignore what’s happening on a national or even global scale. Economic shifts, especially changes in interest rates, have a direct and powerful impact on the Dallas market. When rates go up, it can cool off the traditional homebuyer market, which can be an opportunity for investors with cash to negotiate much better deals.

A savvy investor doesn’t just watch the local Dallas news; they understand how a decision made in another country can ripple all the way down to their specific street corner in Dallas. This is what separates reactive investors from those who anticipate the market.

These broader trends also shape how other investors are feeling and acting. For instance, recent global data paints a complex picture. In early 2025, worldwide real estate transaction volumes dipped slightly by 2% year-over-year, with things slowing down in most sectors. Yet, the Americas region was a bright spot, showing resilience. Digging into these nuances, like in the latest real estate report from UBS, gives you an edge over the competition in Dallas.

Ultimately, mastering how to find investment properties in Dallas means keeping one eye on the individual property and its neighborhood, and the other on the larger economic forces at play. This balanced approach ensures you’re not just buying a building—you’re making a smart, calculated investment in the dynamic Dallas ecosystem.

From Offer to Closing in the Dallas Market

So you’ve run the numbers, vetted the Dallas neighborhood, and found a property that checks all the boxes. Great. Now comes the part where the rubber really meets the road: getting that deal under contract and to the closing table.

In a market as active as Dallas, this is a game of speed, strategy, and a little bit of finesse. A compelling offer isn’t just about throwing the highest number at the seller; it’s about making your proposal clean, confident, and the easiest path forward for them. That means having your financing ready to go and being prepared to move without hesitation.

Crafting an Offer That Stands Out

When a good property hits the market in Dallas, offers fly in fast. You need yours to cut through the noise. While a strong price is always a good starting point, other terms can be just as powerful.

One move I often see work wonders is offering a larger-than-average earnest money deposit. It’s a tangible way to signal you’re a serious, committed buyer.

Even better? Tighten up your option period. The standard in Texas is often 10-14 days, which gives you an unrestricted right to terminate the contract. Proposing a 7-day option period instead tells the seller you’re confident and ready to get inspections done quickly. This can be incredibly attractive to a seller in Dallas who wants certainty.

Your offer’s real job is to solve the seller’s problem. Make their life easier with a smooth, predictable process, and you’ll jump to the front of the line—even if you’re not the highest bidder.

Assembling Your Dallas Power Team

Let me be clear: you can’t navigate the Dallas closing process on your own and expect the best outcome. You absolutely need a team of local pros who live and breathe Dallas real estate. This is what we call a “power team,” and it’s your most valuable asset once an offer is accepted.

Your team should include:

- A Property Inspector: Don’t just get any inspector. Find one who understands the unique challenges of North Texas—from our infamous foundation issues to the quirks of older homes in neighborhoods like East Dallas or Oak Cliff.

- An Investment-Focused Attorney: While not always mandatory in Texas, having a real estate attorney review your contracts can be a lifesaver, especially if the deal has any complexity. It’s cheap insurance against a major mistake.

- A Responsive Title Company: A great local Dallas title company is the unsung hero of the transaction. They handle the nitty-gritty legal paperwork and ensure the closing itself is seamless and on time.

As you move toward closing, you’ll be juggling a mountain of paperwork. Staying organized is non-negotiable. You can find some expert tips on real estate document management to help keep everything in order.

With the right team backing you, you can move confidently from an accepted offer to holding the keys to your new Dallas investment property.

Common Questions About Dallas Real Estate Investing

Let’s be honest, jumping into the Dallas real estate market always comes with a flood of questions. Even if you’ve been investing for years, every city has its own quirks and pitfalls. Getting straight answers to the big questions is the first step to making a smart move in Dallas.

I hear a lot of the same questions from investors looking to buy in the DFW area. So, let’s cut to the chase and tackle them head-on with some practical, no-fluff answers.

What Are the Best Dallas Neighborhoods for Cash Flow?

The “best” neighborhood is always going to depend on your specific investment strategy, but some parts of Dallas and its suburbs consistently strike a better balance between property price and rental income. That balance is where you find solid cash flow.

For example, I often point investors toward established Dallas suburbs like Garland, Mesquite, and certain pockets of Fort Worth. In these areas, you can still find properties where the purchase price isn’t so high that it wipes out your potential rental income. This is a sharp contrast to high-appreciation markets like Frisco or parts of North Dallas. While those areas are great for long-term growth, the sky-high property values can really squeeze your monthly cash flow. It all comes down to running the numbers for each specific Dallas submarket.

How Much Should I Budget for Dallas Property Taxes and Insurance?

Underestimating your carrying costs is one of the fastest ways to see a great deal go south, and in Dallas, property taxes are a massive piece of that puzzle.

A critical mistake I see new investors make in Dallas is using the seller’s current tax bill for their calculations. Texas is a non-disclosure state, which means the county will almost certainly reassess the property’s value based on what you paid for it. That often leads to a much higher tax bill than you were expecting.

To be safe, I always recommend budgeting between 2.2% to 2.5% of the property’s value for your annual taxes during your initial analysis. For insurance, which can swing depending on the home’s age and flood risk in Dallas, setting aside $2,500 to $4,000 per year is a realistic starting point for a typical single-residence rental.

Can I Still Find Good Dallas Deals Under $300,000?

Yes, you absolutely can. But it’s not going to be easy—you’ll need a targeted search and probably a bit of creative thinking in the Dallas market.

Most properties under the $300,000 mark are going to be in Dallas suburbs a bit further out from the city center. You’ll also find them in the form of homes that need some work, which makes them a perfect fit for a BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategy.

You can also find condos and townhomes in more central Dallas locations that fall into this price range. To uncover these opportunities, you really have to look beyond the MLS. This means building relationships with wholesalers and actively hunting for off-market properties. For instance, our complete guide to buying in Casa View dives into an East Dallas neighborhood where these more accessible price points can still be found.

Navigating the Dallas market requires local expertise and a proactive approach. If you’re ready to find your next investment property, the team at Dustin Pitts REALTOR Dallas Real Estate Agent is here to provide the guidance and access you need to succeed. Visit us at https://dustinpitts.com to start your search today.